A Closer Look at ARM Holdings's Options Market Dynamics

A Closer Look at ARM Holdings's Options Market Dynamics

Financial giants have made a conspicuous bullish move on ARM Holdings. Our analysis of options history for ARM Holdings (NASDAQ:ARM) revealed 9 unusual trades.

金融巨頭對ARM Holdings採取了明顯的看漲舉動。我們對ARM Holdings(納斯達克股票代碼:ARM)期權歷史的分析顯示了9筆不尋常的交易。

Delving into the details, we found 66% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $134,375, and 7 were calls, valued at $2,648,365.

深入研究細節,我們發現66%的交易者看漲,而33%的交易者表現出看跌趨勢。在我們發現的所有交易中,有2筆是看跌期權,價值爲134,375美元,7筆是看漲期權,價值2648,365美元。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $65.0 to $73.0 for ARM Holdings over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將ARM Holdings的價格定在65.0美元至73.0美元之間。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平倉合約是一種對股票進行盡職調查的有見地的方法。

This data can help you track the liquidity and interest for ARM Holdings's options for a given strike price.

這些數據可以幫助您跟蹤給定行使價下ARM Holdings期權的流動性和利息。

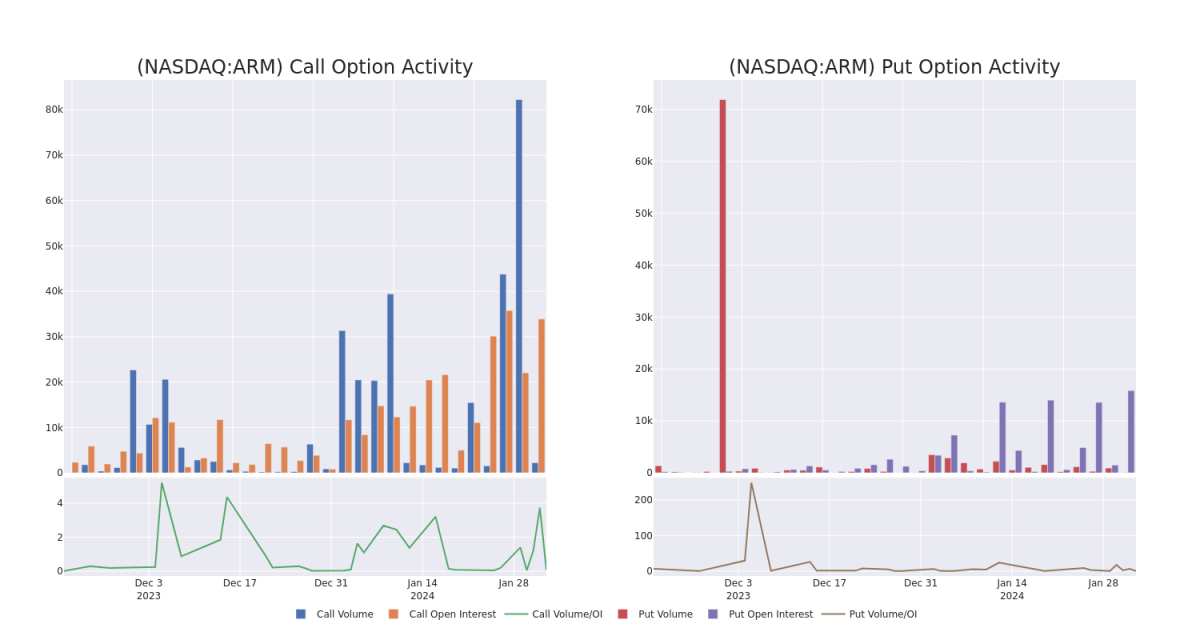

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of ARM Holdings's whale activity within a strike price range from $65.0 to $73.0 in the last 30 days.

下面,我們可以觀察過去30天在65.0美元至73.0美元行使價區間內,ARM Holdings所有鯨魚活動的看漲和看跌期權交易量和未平倉合約的分別變化。

ARM Holdings Option Volume And Open Interest Over Last 30 Days

ARM Holdings 過去 30 天的期權交易量和未平倉合約

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| ARM | CALL | TRADE | BULLISH | 01/16/26 | $70.00 | $2.3M | 24.4K | 2 |

| ARM | PUT | SWEEP | BEARISH | 02/16/24 | $70.00 | $103.6K | 2.4K | 10 |

| ARM | CALL | TRADE | BULLISH | 08/16/24 | $72.50 | $67.0K | 1.9K | 0 |

| ARM | CALL | SWEEP | NEUTRAL | 04/19/24 | $65.00 | $51.9K | 6.9K | 50 |

| ARM | CALL | TRADE | BULLISH | 01/16/26 | $70.00 | $47.0K | 24.4K | 1.0K |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|

| 手臂 | 打電話 | 貿易 | 看漲 | 01/16/26 | 70.00 美元 | 230 萬美元 | 24.4K | 2 |

| 手臂 | 放 | 掃 | 粗魯的 | 02/16/24 | 70.00 美元 | 103.6 萬美元 | 2.4K | 10 |

| 手臂 | 打電話 | 貿易 | 看漲 | 08/16/24 | 72.50 美元 | 67.0 萬美元 | 1.9K | 0 |

| 手臂 | 打電話 | 掃 | 中立 | 04/19/24 | 65.00 美元 | 51.9 萬美元 | 6.9K | 50 |

| 手臂 | 打電話 | 貿易 | 看漲 | 01/16/26 | 70.00 美元 | 47.0 萬美元 | 24.4K | 1.0K |

About ARM Holdings

關於 ARM 控股

Arm Holdings is the IP owner and developer of the ARM architecture (ARM stands for Acorn RISC Machine), which is used in 99% of the world's smartphone CPU cores, and it also has high market share in other battery-powered devices like wearables, tablets, or sensors. Arm licenses its architecture for a fee, offering different types of licenses depending on the flexibility the customer needs. Customers like Apple or Qualcomm buy architectural licenses, which allows them to modify the architecture and add or delete instructions to tailor the chips to their specific needs. Other clients directly buy off-the-shelf designs from Arm. Both off-the-shelf and architectural customers pay a royalty fee per chip shipped.

Arm Holdings是ARM架構(ARM代表Acorn RISC Machine)的知識產權所有者和開發商,該架構用於全球99%的智能手機CPU內核,並且在可穿戴設備、平板電腦或傳感器等其他電池供電設備中也佔有很高的市場份額。Arm 需要付費許可其架構,根據客戶需要的靈活性提供不同類型的許可證。蘋果或高通等客戶購買架構許可證,這允許他們修改架構並添加或刪除指令,以根據自己的特定需求定製芯片。其他客戶直接從Arm購買現成的設計。現成客戶和建築客戶都要爲每出貨的芯片支付特許權使用費。

ARM Holdings's Current Market Status

ARM Holdings的當前市場狀況

- Currently trading with a volume of 717,679, the ARM's price is up by 0.78%, now at $71.07.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 5 days.

- ARM目前的交易量爲717,679美元,價格上漲了0.78%,目前爲71.07美元。

- RSI讀數表明,該股目前可能接近超買。

- 預計業績將在5天后發佈。

Professional Analyst Ratings for ARM Holdings

ARM Holdings的專業分析師評級

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $80.0.

在過去的30天中,共有2位專業分析師對該股發表了看法,將平均目標股價設定爲80.0美元。

- An analyst from Mizuho has decided to maintain their Buy rating on ARM Holdings, which currently sits at a price target of $85.

- Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on ARM Holdings with a target price of $75.

- 瑞穗的一位分析師已決定維持對ARM Holdings的買入評級,該評級目前的目標股價爲85美元。

- Keybanc的一位分析師在評估中保持了對ARM Holdings的增持評級,目標價爲75美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest ARM Holdings options trades with real-time alerts from Benzinga Pro.

期權交易帶來更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。通過Benzinga Pro的實時提醒,隨時了解ARM Holdings的最新期權交易。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.