To the annoyance of some shareholders, Guangdong Piano Customized Furniture Co., Ltd. (SZSE:002853) shares are down a considerable 28% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

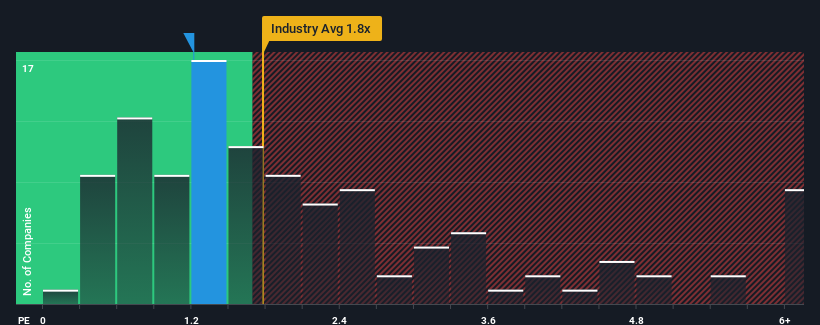

Following the heavy fall in price, when close to half the companies operating in China's Consumer Durables industry have price-to-sales ratios (or "P/S") above 1.8x, you may consider Guangdong Piano Customized Furniture as an enticing stock to check out with its 1.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Guangdong Piano Customized Furniture Performed Recently?

For instance, Guangdong Piano Customized Furniture's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Guangdong Piano Customized Furniture will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Guangdong Piano Customized Furniture's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Guangdong Piano Customized Furniture's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.9%. The last three years don't look nice either as the company has shrunk revenue by 5.0% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 12% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we understand why Guangdong Piano Customized Furniture's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does Guangdong Piano Customized Furniture's P/S Mean For Investors?

Guangdong Piano Customized Furniture's recently weak share price has pulled its P/S back below other Consumer Durables companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Guangdong Piano Customized Furniture maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Guangdong Piano Customized Furniture that you should be aware of.

If these risks are making you reconsider your opinion on Guangdong Piano Customized Furniture, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.