To the annoyance of some shareholders, Zhejiang East Asia Pharmaceutical Co., Ltd. (SHSE:605177) shares are down a considerable 31% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 22% share price drop.

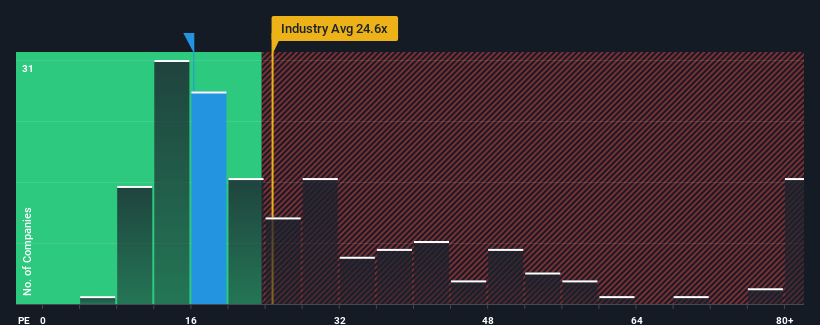

After such a large drop in price, Zhejiang East Asia Pharmaceutical's price-to-earnings (or "P/E") ratio of 16.2x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 28x and even P/E's above 50x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Zhejiang East Asia Pharmaceutical certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Zhejiang East Asia Pharmaceutical would need to produce sluggish growth that's trailing the market.

In order to justify its P/E ratio, Zhejiang East Asia Pharmaceutical would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 68% last year. Still, incredibly EPS has fallen 34% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 39% over the next year. With the market predicted to deliver 41% growth , the company is positioned for a comparable earnings result.

With this information, we find it odd that Zhejiang East Asia Pharmaceutical is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

The softening of Zhejiang East Asia Pharmaceutical's shares means its P/E is now sitting at a pretty low level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Zhejiang East Asia Pharmaceutical's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Plus, you should also learn about these 4 warning signs we've spotted with Zhejiang East Asia Pharmaceutical (including 2 which are concerning).

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.