The Shenzhen Techwinsemi Technology Co., Ltd. (SZSE:001309) share price has fared very poorly over the last month, falling by a substantial 27%. Still, a bad month hasn't completely ruined the past year with the stock gaining 39%, which is great even in a bull market.

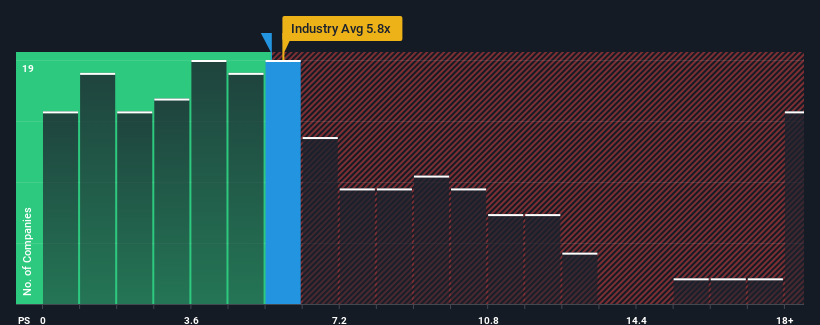

In spite of the heavy fall in price, there still wouldn't be many who think Shenzhen Techwinsemi Technology's price-to-sales (or "P/S") ratio of 5.5x is worth a mention when the median P/S in China's Semiconductor industry is similar at about 5.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Shenzhen Techwinsemi Technology Performed Recently?

With revenue growth that's inferior to most other companies of late, Shenzhen Techwinsemi Technology has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shenzhen Techwinsemi Technology.Do Revenue Forecasts Match The P/S Ratio?

Shenzhen Techwinsemi Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Shenzhen Techwinsemi Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. The latest three year period has also seen an excellent 60% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 45% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 35%, which is noticeably less attractive.

In light of this, it's curious that Shenzhen Techwinsemi Technology's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Following Shenzhen Techwinsemi Technology's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shenzhen Techwinsemi Technology currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Shenzhen Techwinsemi Technology (1 doesn't sit too well with us) you should be aware of.

If these risks are making you reconsider your opinion on Shenzhen Techwinsemi Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.