Unfortunately for some shareholders, the Sailong Pharmaceutical Group Co.,Ltd. (SZSE:002898) share price has dived 29% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 16% share price drop.

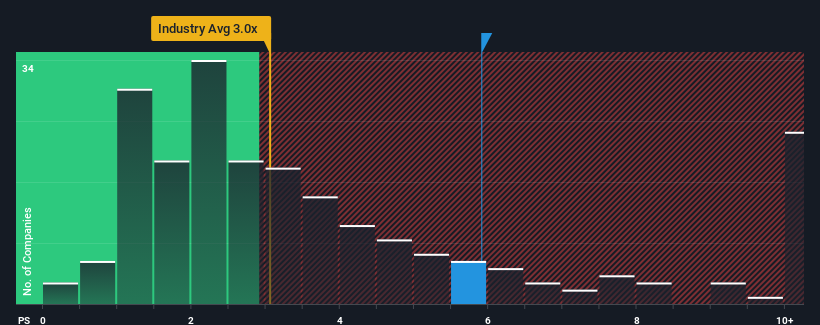

In spite of the heavy fall in price, you could still be forgiven for thinking Sailong Pharmaceutical GroupLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.9x, considering almost half the companies in China's Pharmaceuticals industry have P/S ratios below 3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Sailong Pharmaceutical GroupLtd's P/S Mean For Shareholders?

The revenue growth achieved at Sailong Pharmaceutical GroupLtd over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sailong Pharmaceutical GroupLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

Sailong Pharmaceutical GroupLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Sailong Pharmaceutical GroupLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. The strong recent performance means it was also able to grow revenue by 45% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 35% shows it's noticeably less attractive.

In light of this, it's alarming that Sailong Pharmaceutical GroupLtd's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

A significant share price dive has done very little to deflate Sailong Pharmaceutical GroupLtd's very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Sailong Pharmaceutical GroupLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

You should always think about risks. Case in point, we've spotted 1 warning sign for Sailong Pharmaceutical GroupLtd you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.