Guangzhou Zhiguang Electric Co., Ltd. (SZSE:002169) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

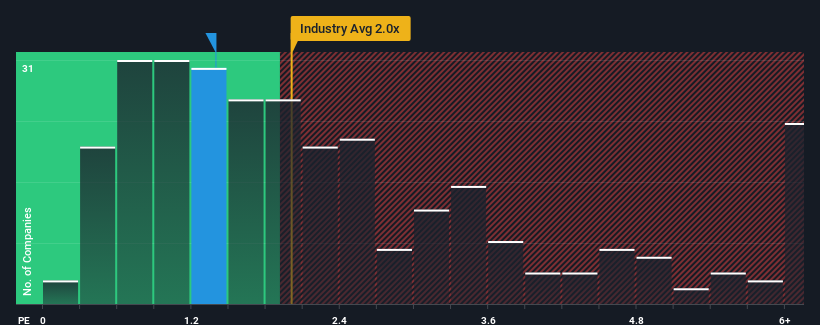

Although its price has dipped substantially, considering around half the companies operating in China's Electrical industry have price-to-sales ratios (or "P/S") above 2x, you may still consider Guangzhou Zhiguang Electric as an solid investment opportunity with its 1.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Guangzhou Zhiguang Electric Has Been Performing

Recent times have been quite advantageous for Guangzhou Zhiguang Electric as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Guangzhou Zhiguang Electric will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Guangzhou Zhiguang Electric will help you shine a light on its historical performance.How Is Guangzhou Zhiguang Electric's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Guangzhou Zhiguang Electric's is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Guangzhou Zhiguang Electric's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 32% gain to the company's top line. Revenue has also lifted 12% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 27% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why Guangzhou Zhiguang Electric's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Key Takeaway

The southerly movements of Guangzhou Zhiguang Electric's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

In line with expectations, Guangzhou Zhiguang Electric maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for Guangzhou Zhiguang Electric (2 are concerning!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.