Dalian Haosen Equipment Manufacturing Co., Ltd. (SHSE:688529) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 35% in that time.

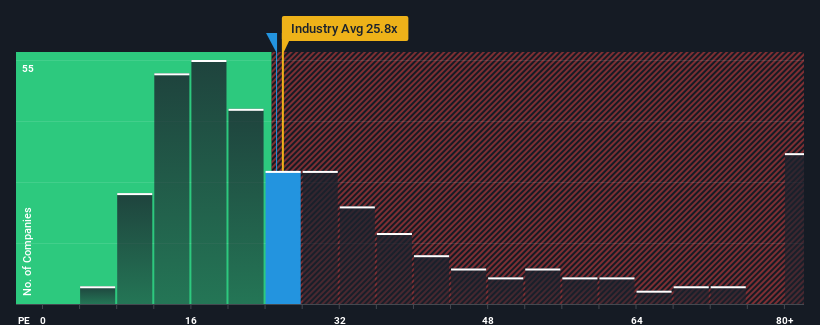

In spite of the heavy fall in price, there still wouldn't be many who think Dalian Haosen Equipment Manufacturing's price-to-earnings (or "P/E") ratio of 25.1x is worth a mention when the median P/E in China is similar at about 28x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

There hasn't been much to differentiate Dalian Haosen Equipment Manufacturing's and the market's retreating earnings lately. The P/E is probably moderate because investors think the company's earnings trend will continue to follow the rest of the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. At the very least, you'd be hoping that earnings don't accelerate downwards if your plan is to pick up some stock while it's not in favour.

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Dalian Haosen Equipment Manufacturing's is when the company's growth is tracking the market closely.

The only time you'd be comfortable seeing a P/E like Dalian Haosen Equipment Manufacturing's is when the company's growth is tracking the market closely.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 33% decline in EPS over the last three years in total. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 137% as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

In light of this, it's curious that Dalian Haosen Equipment Manufacturing's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Dalian Haosen Equipment Manufacturing's P/E?

Following Dalian Haosen Equipment Manufacturing's share price tumble, its P/E is now hanging on to the median market P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Dalian Haosen Equipment Manufacturing's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Dalian Haosen Equipment Manufacturing (including 1 which is a bit concerning).

Of course, you might also be able to find a better stock than Dalian Haosen Equipment Manufacturing. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.