Zhejiang Yuejian Intelligent Equipment Co.,Ltd. (SHSE:603095) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 32% in that time.

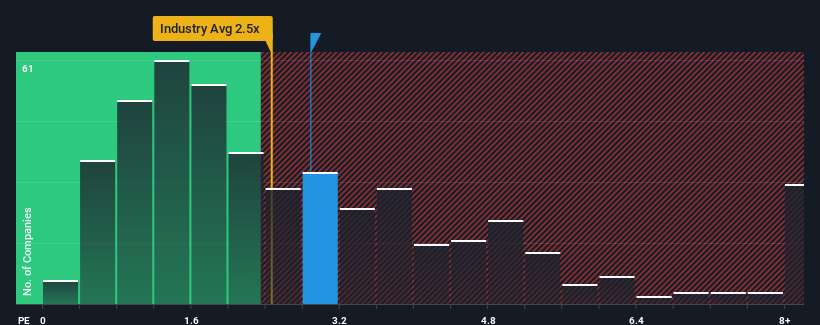

Although its price has dipped substantially, there still wouldn't be many who think Zhejiang Yuejian Intelligent EquipmentLtd's price-to-sales (or "P/S") ratio of 2.9x is worth a mention when the median P/S in China's Machinery industry is similar at about 2.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Zhejiang Yuejian Intelligent EquipmentLtd Has Been Performing

For example, consider that Zhejiang Yuejian Intelligent EquipmentLtd's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhejiang Yuejian Intelligent EquipmentLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Zhejiang Yuejian Intelligent EquipmentLtd's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Zhejiang Yuejian Intelligent EquipmentLtd's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 50% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 18% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to deliver 28% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's curious that Zhejiang Yuejian Intelligent EquipmentLtd's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Zhejiang Yuejian Intelligent EquipmentLtd's P/S Mean For Investors?

Following Zhejiang Yuejian Intelligent EquipmentLtd's share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Zhejiang Yuejian Intelligent EquipmentLtd's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Zhejiang Yuejian Intelligent EquipmentLtd (1 is a bit unpleasant) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.