Jiangsu Maysta Chemical Co., Ltd. (SHSE:603041) shares have had a horrible month, losing 29% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 19% in that time.

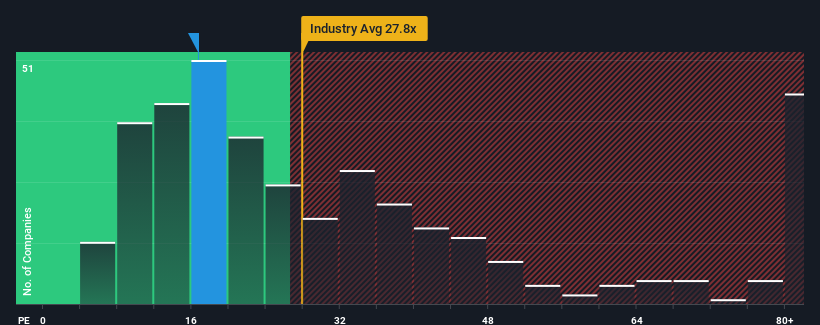

Even after such a large drop in price, Jiangsu Maysta Chemical's price-to-earnings (or "P/E") ratio of 16.7x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 28x and even P/E's above 50x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Earnings have risen firmly for Jiangsu Maysta Chemical recently, which is pleasing to see. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Jiangsu Maysta Chemical would need to produce sluggish growth that's trailing the market.

In order to justify its P/E ratio, Jiangsu Maysta Chemical would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 29%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 23% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 41% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Jiangsu Maysta Chemical's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Final Word

Jiangsu Maysta Chemical's recently weak share price has pulled its P/E below most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Jiangsu Maysta Chemical revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Jiangsu Maysta Chemical (of which 1 is a bit concerning!) you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.