To the annoyance of some shareholders, Zhejiang Xiantong Rubber&Plastic Co.,Ltd (SHSE:603239) shares are down a considerable 25% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 29% share price drop.

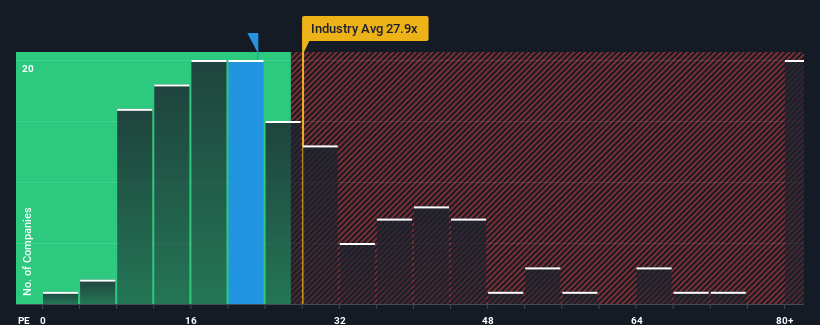

In spite of the heavy fall in price, Zhejiang Xiantong Rubber&PlasticLtd's price-to-earnings (or "P/E") ratio of 23.1x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 28x and even P/E's above 50x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Earnings have risen at a steady rate over the last year for Zhejiang Xiantong Rubber&PlasticLtd, which is generally not a bad outcome. It might be that many expect the respectable earnings performance to degrade, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Is There Any Growth For Zhejiang Xiantong Rubber&PlasticLtd?

There's an inherent assumption that a company should underperform the market for P/E ratios like Zhejiang Xiantong Rubber&PlasticLtd's to be considered reasonable.

There's an inherent assumption that a company should underperform the market for P/E ratios like Zhejiang Xiantong Rubber&PlasticLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 4.2% gain to the company's bottom line. The solid recent performance means it was also able to grow EPS by 25% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 41% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Zhejiang Xiantong Rubber&PlasticLtd is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Zhejiang Xiantong Rubber&PlasticLtd's P/E

Zhejiang Xiantong Rubber&PlasticLtd's P/E has taken a tumble along with its share price. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Zhejiang Xiantong Rubber&PlasticLtd maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for Zhejiang Xiantong Rubber&PlasticLtd that you need to take into consideration.

Of course, you might also be able to find a better stock than Zhejiang Xiantong Rubber&PlasticLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.