The Guangdong Transtek Medical Electronics Co., Ltd (SZSE:300562) share price has fared very poorly over the last month, falling by a substantial 30%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 19% share price drop.

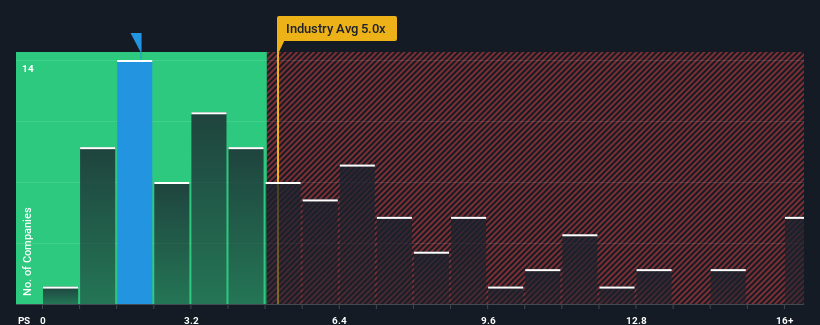

Following the heavy fall in price, Guangdong Transtek Medical Electronics may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.1x, since almost half of all companies in the Medical Equipment industry in China have P/S ratios greater than 5x and even P/S higher than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

How Guangdong Transtek Medical Electronics Has Been Performing

While the industry has experienced revenue growth lately, Guangdong Transtek Medical Electronics' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guangdong Transtek Medical Electronics.Do Revenue Forecasts Match The Low P/S Ratio?

Guangdong Transtek Medical Electronics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Guangdong Transtek Medical Electronics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 40%. As a result, revenue from three years ago have also fallen 25% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 33% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

With this information, we find it odd that Guangdong Transtek Medical Electronics is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Guangdong Transtek Medical Electronics' P/S?

Having almost fallen off a cliff, Guangdong Transtek Medical Electronics' share price has pulled its P/S way down as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at Guangdong Transtek Medical Electronics' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Guangdong Transtek Medical Electronics with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.