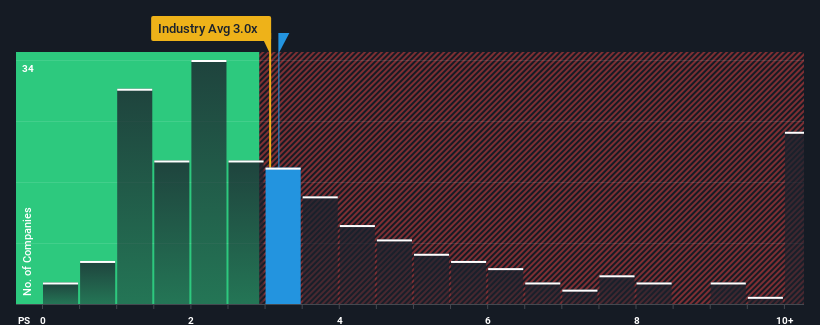

It's not a stretch to say that Honz Pharmaceutical Co., Ltd.'s (SZSE:300086) price-to-sales (or "P/S") ratio of 3.2x right now seems quite "middle-of-the-road" for companies in the Pharmaceuticals industry in China, where the median P/S ratio is around 3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does Honz Pharmaceutical's Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for Honz Pharmaceutical, which is generally not a bad outcome. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Honz Pharmaceutical, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Honz Pharmaceutical's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Honz Pharmaceutical's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.5% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 27% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.5% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 27% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 35% shows it's an unpleasant look.

With this information, we find it concerning that Honz Pharmaceutical is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Honz Pharmaceutical's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We find it unexpected that Honz Pharmaceutical trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Honz Pharmaceutical, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Honz Pharmaceutical, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.