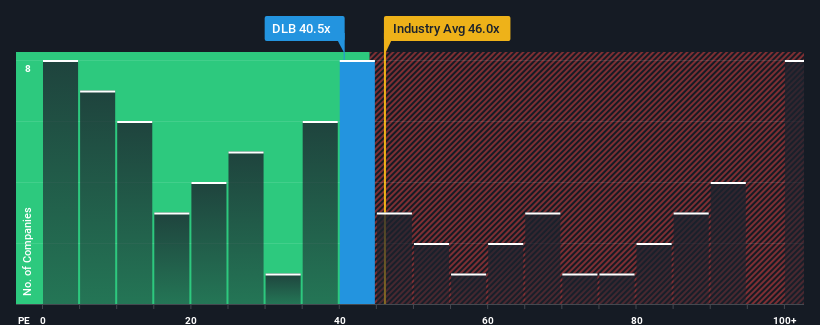

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider Dolby Laboratories, Inc. (NYSE:DLB) as a stock to avoid entirely with its 40.5x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Dolby Laboratories certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Is There Enough Growth For Dolby Laboratories?

The only time you'd be truly comfortable seeing a P/E as steep as Dolby Laboratories' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 5.9%. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 37% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

If we review the last year of earnings growth, the company posted a worthy increase of 5.9%. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 37% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 17% per annum as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 12% per year growth forecast for the broader market.

With this information, we can see why Dolby Laboratories is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Dolby Laboratories' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Dolby Laboratories maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Dolby Laboratories with six simple checks on some of these key factors.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.