Hunan Oil Pump Co., Ltd. (SHSE:603319) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 22% in that time.

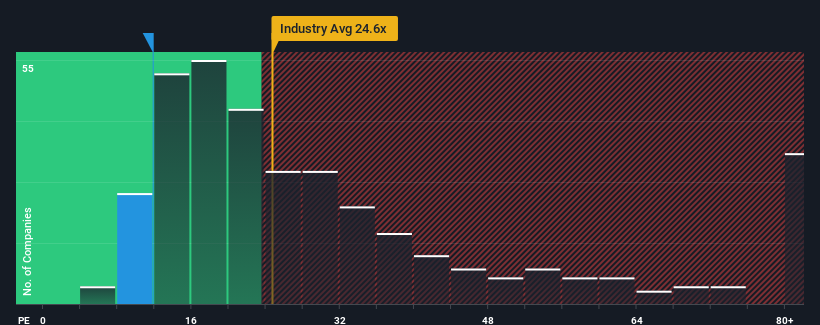

Following the heavy fall in price, Hunan Oil Pump may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 11.8x, since almost half of all companies in China have P/E ratios greater than 27x and even P/E's higher than 48x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Hunan Oil Pump as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Is There Any Growth For Hunan Oil Pump?

In order to justify its P/E ratio, Hunan Oil Pump would need to produce anemic growth that's substantially trailing the market.

In order to justify its P/E ratio, Hunan Oil Pump would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 32% gain to the company's bottom line. As a result, it also grew EPS by 23% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 40% over the next year. With the market predicted to deliver 42% growth , the company is positioned for a comparable earnings result.

With this information, we find it odd that Hunan Oil Pump is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Having almost fallen off a cliff, Hunan Oil Pump's share price has pulled its P/E way down as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Hunan Oil Pump's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Hunan Oil Pump, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Hunan Oil Pump, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.