The Ningbo Lehui International Engineering Equipment Co.,Ltd (SHSE:603076) share price has fared very poorly over the last month, falling by a substantial 25%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

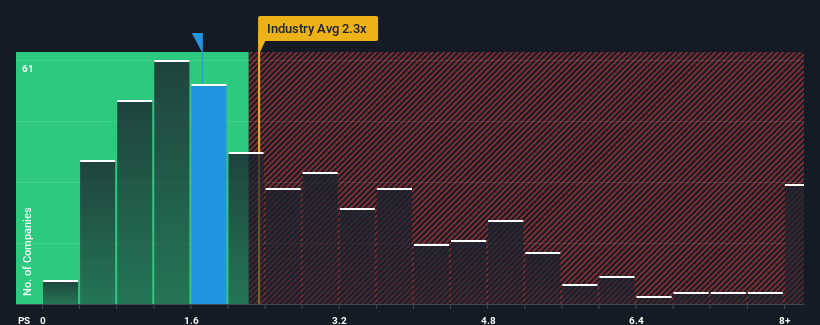

Although its price has dipped substantially, it would still be understandable if you think Ningbo Lehui International Engineering EquipmentLtd is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 1.7x, considering almost half the companies in China's Machinery industry have P/S ratios above 2.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Ningbo Lehui International Engineering EquipmentLtd Has Been Performing

The revenue growth achieved at Ningbo Lehui International Engineering EquipmentLtd over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Ningbo Lehui International Engineering EquipmentLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Ningbo Lehui International Engineering EquipmentLtd?

The only time you'd be truly comfortable seeing a P/S as low as Ningbo Lehui International Engineering EquipmentLtd's is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Ningbo Lehui International Engineering EquipmentLtd's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 80% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 27% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Ningbo Lehui International Engineering EquipmentLtd's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What Does Ningbo Lehui International Engineering EquipmentLtd's P/S Mean For Investors?

The southerly movements of Ningbo Lehui International Engineering EquipmentLtd's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Ningbo Lehui International Engineering EquipmentLtd revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Ningbo Lehui International Engineering EquipmentLtd (1 doesn't sit too well with us!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.