For many, the main point of investing is to generate higher returns than the overall market. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Kingsignal Technology Co., Ltd. (SZSE:300252) shareholders for doubting their decision to hold, with the stock down 46% over a half decade. And it's not just long term holders hurting, because the stock is down 25% in the last year. The falls have accelerated recently, with the share price down 35% in the last three months. However, one could argue that the price has been influenced by the general market, which is down 17% in the same timeframe.

With the stock having lost 21% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

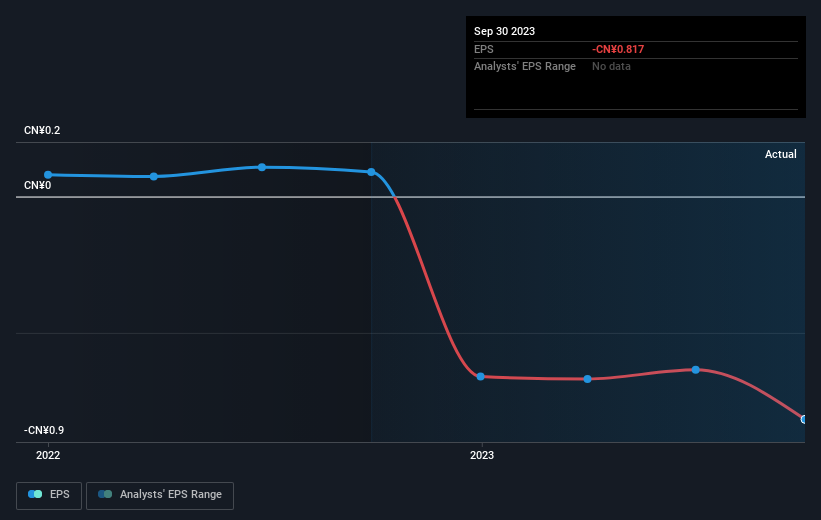

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

In the last half decade Kingsignal Technology saw its share price fall as its EPS declined below zero. At present it's hard to make valid comparisons between EPS and the share price. However, we can say we'd expect to see a falling share price in this scenario.

In the last half decade Kingsignal Technology saw its share price fall as its EPS declined below zero. At present it's hard to make valid comparisons between EPS and the share price. However, we can say we'd expect to see a falling share price in this scenario.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Kingsignal Technology's key metrics by checking this interactive graph of Kingsignal Technology's earnings, revenue and cash flow.

A Different Perspective

Kingsignal Technology shareholders are down 25% over twelve months, which isn't far from the market return of -26%. Unfortunately, last year's performance is a deterioration of an already poor long term track record, given the loss of 8% per year over the last five years. It will probably take a substantial improvement in the fundamental performance for the company to reverse this trend. It's always interesting to track share price performance over the longer term. But to understand Kingsignal Technology better, we need to consider many other factors. Take risks, for example - Kingsignal Technology has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.