The Nanjing OLO Home Furnishing Co.,Ltd (SHSE:603326) share price has fared very poorly over the last month, falling by a substantial 25%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 20% share price drop.

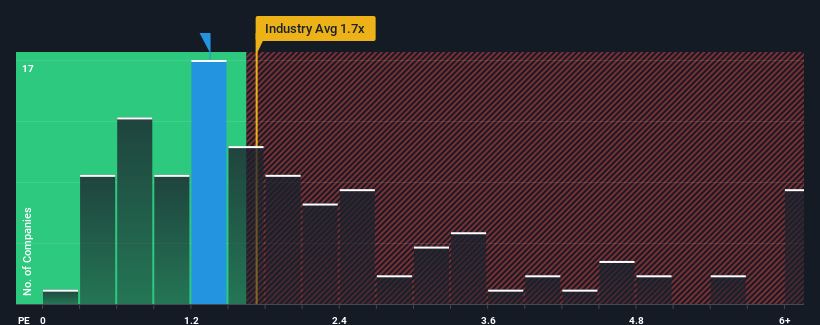

In spite of the heavy fall in price, it's still not a stretch to say that Nanjing OLO Home FurnishingLtd's price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" compared to the Consumer Durables industry in China, where the median P/S ratio is around 1.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Nanjing OLO Home FurnishingLtd Has Been Performing

Recent revenue growth for Nanjing OLO Home FurnishingLtd has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Keen to find out how analysts think Nanjing OLO Home FurnishingLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Nanjing OLO Home FurnishingLtd would need to produce growth that's similar to the industry.

In order to justify its P/S ratio, Nanjing OLO Home FurnishingLtd would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.5%. Revenue has also lifted 23% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 24% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 12% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Nanjing OLO Home FurnishingLtd's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Nanjing OLO Home FurnishingLtd looks to be in line with the rest of the Consumer Durables industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Nanjing OLO Home FurnishingLtd's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Nanjing OLO Home FurnishingLtd you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.