Jiangsu Chuanzhiboke Education Technology Co., LTD. (SZSE:003032) shareholders won't be pleased to see that the share price has had a very rough month, dropping 36% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

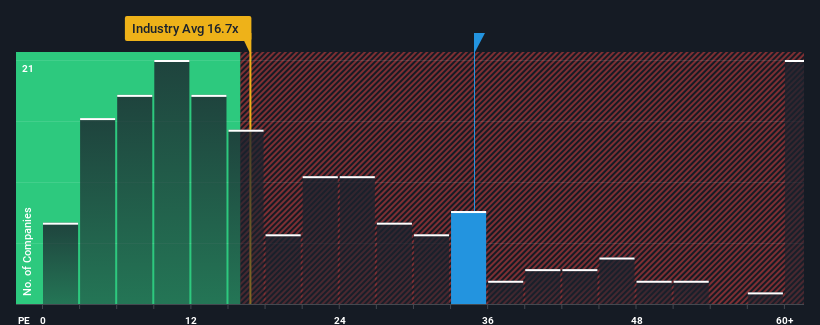

Although its price has dipped substantially, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 26x, you may still consider Jiangsu Chuanzhiboke Education Technology as a stock to potentially avoid with its 34.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times haven't been advantageous for Jiangsu Chuanzhiboke Education Technology as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

How Is Jiangsu Chuanzhiboke Education Technology's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Jiangsu Chuanzhiboke Education Technology's to be considered reasonable.

There's an inherent assumption that a company should outperform the market for P/E ratios like Jiangsu Chuanzhiboke Education Technology's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 34%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 100% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 20% during the coming year according to the seven analysts following the company. That's shaping up to be materially lower than the 42% growth forecast for the broader market.

In light of this, it's alarming that Jiangsu Chuanzhiboke Education Technology's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

There's still some solid strength behind Jiangsu Chuanzhiboke Education Technology's P/E, if not its share price lately. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Jiangsu Chuanzhiboke Education Technology currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for Jiangsu Chuanzhiboke Education Technology you should be aware of, and 1 of them is a bit concerning.

Of course, you might also be able to find a better stock than Jiangsu Chuanzhiboke Education Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.