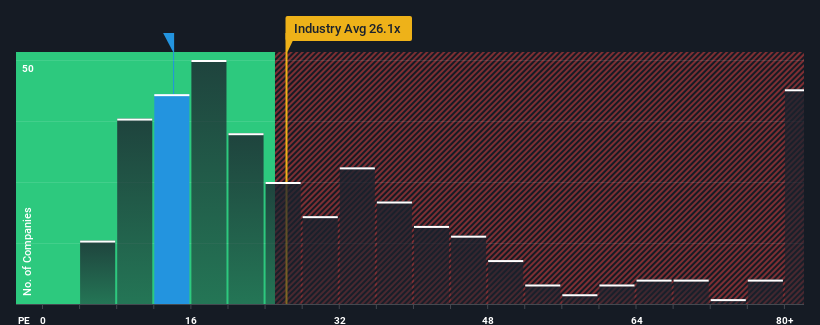

Zhejiang Double Arrow Rubber Co., Ltd.'s (SZSE:002381) price-to-earnings (or "P/E") ratio of 14x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 27x and even P/E's above 48x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been pleasing for Zhejiang Double Arrow Rubber as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Zhejiang Double Arrow Rubber's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 100% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 35% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Retrospectively, the last year delivered an exceptional 100% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 35% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 55% as estimated by the sole analyst watching the company. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

With this information, we find it odd that Zhejiang Double Arrow Rubber is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Zhejiang Double Arrow Rubber currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Zhejiang Double Arrow Rubber that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.