Most people feel a little frustrated if a stock they own goes down in price. But in the short term the market is a voting machine, and the share price movements may not reflect the underlying business performance. Over the year the Enjoyor Technology Co., Ltd. (SZSE:300020) share price fell 26%. However, that's better than the market's overall decline of 26%. Looking at the longer term, the stock is down 24% over three years. In the last ninety days we've seen the share price slide 38%. But this could be related to the weak market, which is down 17% in the same period.

If the past week is anything to go by, investor sentiment for Enjoyor Technology isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the Enjoyor Technology share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

It's surprising to see the share price fall so much, despite the improved EPS. So it's easy to justify a look at some other metrics.

Enjoyor Technology managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

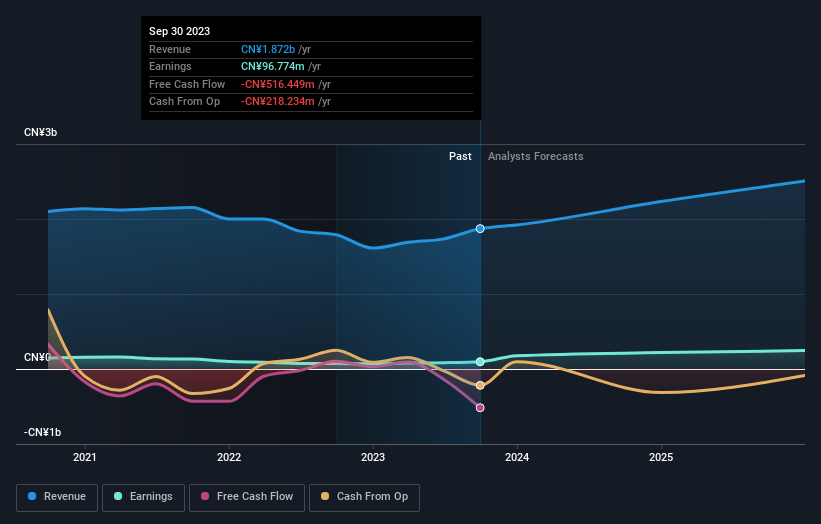

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for Enjoyor Technology in this interactive graph of future profit estimates.

A Different Perspective

The total return of 26% received by Enjoyor Technology shareholders over the last year isn't far from the market return of -26%. So last year was actually even worse than the last five years, which cost shareholders 3% per year. It will probably take a substantial improvement in the fundamental performance for the company to reverse this trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Enjoyor Technology you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.