Ideally, your overall portfolio should beat the market average. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Guangdong Jialong Food Co., Ltd. (SZSE:002495), since the last five years saw the share price fall 22%. Unfortunately the last month hasn't been any better, with the share price down 27%. However, we note the price may have been impacted by the broader market, which is down 13% in the same time period.

With the stock having lost 18% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Because Guangdong Jialong Food made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last five years Guangdong Jialong Food saw its revenue shrink by 5.7% per year. While far from catastrophic that is not good. The share price decline at a rate of 4% per year is disappointing. But it doesn't surprise given the falling revenue. It might be worth watching for signs of a turnaround - buyers are probably expecting one.

In the last five years Guangdong Jialong Food saw its revenue shrink by 5.7% per year. While far from catastrophic that is not good. The share price decline at a rate of 4% per year is disappointing. But it doesn't surprise given the falling revenue. It might be worth watching for signs of a turnaround - buyers are probably expecting one.

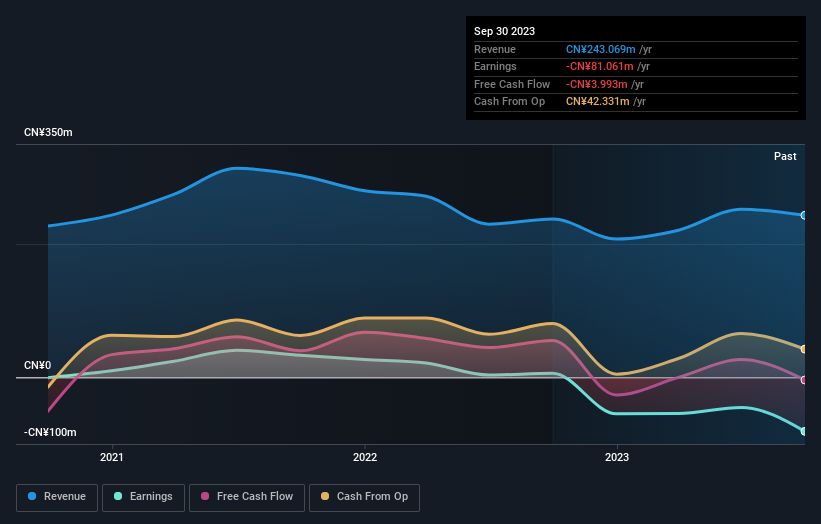

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While it's certainly disappointing to see that Guangdong Jialong Food shares lost 16% throughout the year, that wasn't as bad as the market loss of 26%. Given the total loss of 4% per year over five years, it seems returns have deteriorated in the last twelve months. Whilst Baron Rothschild does tell the investor "buy when there's blood in the streets, even if the blood is your own", buyers would need to examine the data carefully to be comfortable that the business itself is sound. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Guangdong Jialong Food (1 is a bit unpleasant!) that you should be aware of before investing here.

But note: Guangdong Jialong Food may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.