The WPG (Shanghai) Smart Water Public Co.,Ltd. (SHSE:603956) share price has fared very poorly over the last month, falling by a substantial 30%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 33% share price drop.

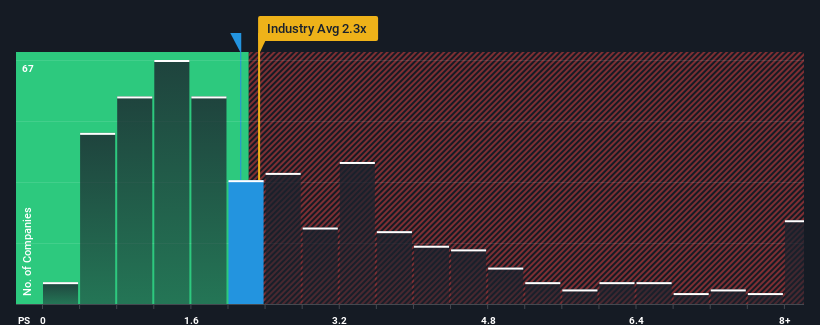

In spite of the heavy fall in price, there still wouldn't be many who think WPG (Shanghai) Smart Water PublicLtd's price-to-sales (or "P/S") ratio of 2.1x is worth a mention when the median P/S in China's Machinery industry is similar at about 2.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How WPG (Shanghai) Smart Water PublicLtd Has Been Performing

WPG (Shanghai) Smart Water PublicLtd certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. Those who are bullish on WPG (Shanghai) Smart Water PublicLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for WPG (Shanghai) Smart Water PublicLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For WPG (Shanghai) Smart Water PublicLtd?

In order to justify its P/S ratio, WPG (Shanghai) Smart Water PublicLtd would need to produce growth that's similar to the industry.

In order to justify its P/S ratio, WPG (Shanghai) Smart Water PublicLtd would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 34% last year. Pleasingly, revenue has also lifted 43% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 27% shows it's noticeably less attractive.

With this in mind, we find it intriguing that WPG (Shanghai) Smart Water PublicLtd's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

With its share price dropping off a cliff, the P/S for WPG (Shanghai) Smart Water PublicLtd looks to be in line with the rest of the Machinery industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that WPG (Shanghai) Smart Water PublicLtd's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with WPG (Shanghai) Smart Water PublicLtd, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on WPG (Shanghai) Smart Water PublicLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.