The Qingdao Victall Railway Co., Ltd. (SHSE:605001) share price has fared very poorly over the last month, falling by a substantial 30%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

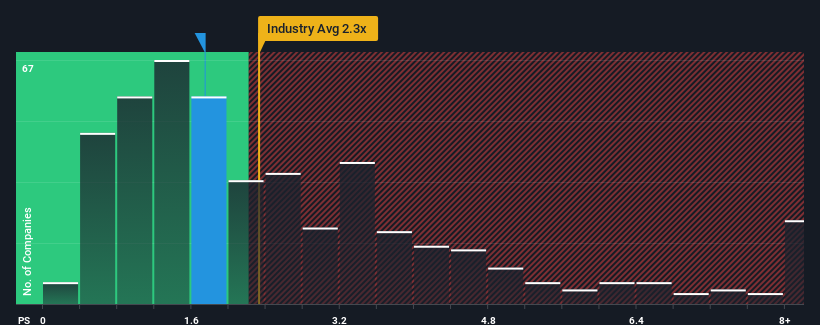

Following the heavy fall in price, given about half the companies operating in China's Machinery industry have price-to-sales ratios (or "P/S") above 2.3x, you may consider Qingdao Victall Railway as an attractive investment with its 1.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Qingdao Victall Railway Has Been Performing

Qingdao Victall Railway certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Qingdao Victall Railway will help you shine a light on its historical performance.How Is Qingdao Victall Railway's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Qingdao Victall Railway's to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Qingdao Victall Railway's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 68%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 21% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 27% shows it's an unpleasant look.

With this in mind, we understand why Qingdao Victall Railway's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Qingdao Victall Railway's P/S Mean For Investors?

The southerly movements of Qingdao Victall Railway's shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Qingdao Victall Railway confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Qingdao Victall Railway you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.