Unfortunately for some shareholders, the Lushang Freda Pharmaceutical Co.,Ltd. (SHSE:600223) share price has dived 28% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

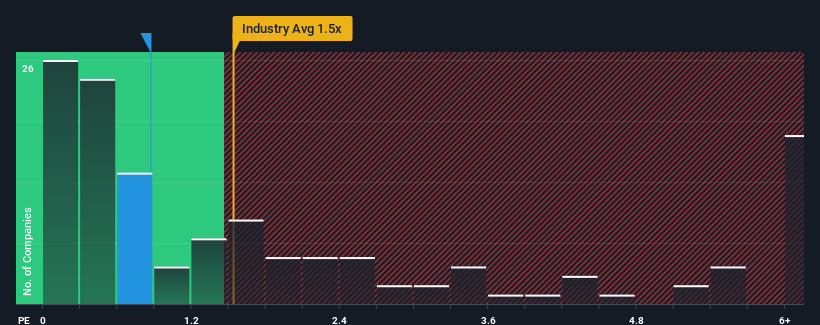

Even after such a large drop in price, Lushang Freda PharmaceuticalLtd's price-to-sales (or "P/S") ratio of 0.9x might still make it look like a buy right now compared to the Real Estate industry in China, where around half of the companies have P/S ratios above 1.5x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Lushang Freda PharmaceuticalLtd's P/S Mean For Shareholders?

Lushang Freda PharmaceuticalLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Lushang Freda PharmaceuticalLtd.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Lushang Freda PharmaceuticalLtd's to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Lushang Freda PharmaceuticalLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 46%. As a result, revenue from three years ago have also fallen 24% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue growth is heading into negative territory, declining 39% over the next year. Meanwhile, the broader industry is forecast to expand by 9.7%, which paints a poor picture.

In light of this, it's understandable that Lushang Freda PharmaceuticalLtd's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

The southerly movements of Lushang Freda PharmaceuticalLtd's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Lushang Freda PharmaceuticalLtd's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Lushang Freda PharmaceuticalLtd's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You should always think about risks. Case in point, we've spotted 2 warning signs for Lushang Freda PharmaceuticalLtd you should be aware of.

If you're unsure about the strength of Lushang Freda PharmaceuticalLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.