Shenzhen Crastal Technology Co.,Ltd (SZSE:300824) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

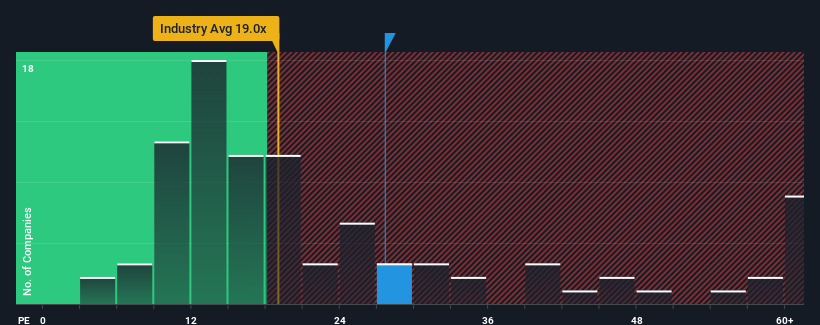

In spite of the heavy fall in price, there still wouldn't be many who think Shenzhen Crastal TechnologyLtd's price-to-earnings (or "P/E") ratio of 27.6x is worth a mention when the median P/E in China is similar at about 26x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Shenzhen Crastal TechnologyLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

How Is Shenzhen Crastal TechnologyLtd's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Shenzhen Crastal TechnologyLtd's to be considered reasonable.

There's an inherent assumption that a company should be matching the market for P/E ratios like Shenzhen Crastal TechnologyLtd's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 9.1%. Still, lamentably EPS has fallen 35% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 22% over the next year. That's shaping up to be materially lower than the 41% growth forecast for the broader market.

In light of this, it's curious that Shenzhen Crastal TechnologyLtd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Shenzhen Crastal TechnologyLtd's plummeting stock price has brought its P/E right back to the rest of the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shenzhen Crastal TechnologyLtd's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Shenzhen Crastal TechnologyLtd that you should be aware of.

If you're unsure about the strength of Shenzhen Crastal TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.