The Shandong Haihua Co.,Ltd (SZSE:000822) share price has fared very poorly over the last month, falling by a substantial 25%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

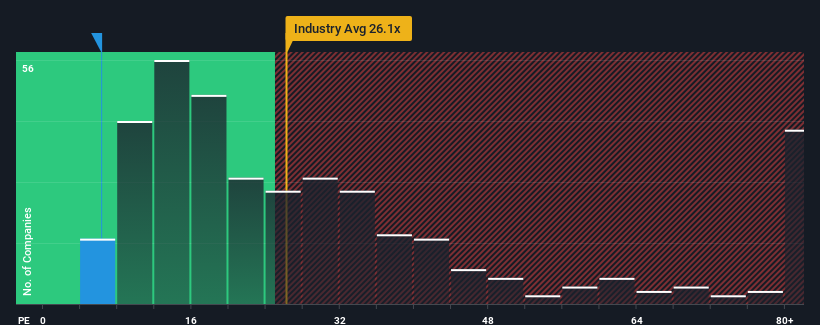

Since its price has dipped substantially, Shandong HaihuaLtd may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.3x, since almost half of all companies in China have P/E ratios greater than 27x and even P/E's higher than 48x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Shandong HaihuaLtd has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Is There Any Growth For Shandong HaihuaLtd?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Shandong HaihuaLtd's to be considered reasonable.

There's an inherent assumption that a company should far underperform the market for P/E ratios like Shandong HaihuaLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 45%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 45% over the next year. That's shaping up to be similar to the 41% growth forecast for the broader market.

With this information, we find it odd that Shandong HaihuaLtd is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Shandong HaihuaLtd's P/E?

Shandong HaihuaLtd's P/E looks about as weak as its stock price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shandong HaihuaLtd's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Shandong HaihuaLtd you should be aware of.

Of course, you might also be able to find a better stock than Shandong HaihuaLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.