Unfortunately for some shareholders, the Anhui Jianghuai Automobile Group Corp.,Ltd. (SHSE:600418) share price has dived 28% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 37% share price drop.

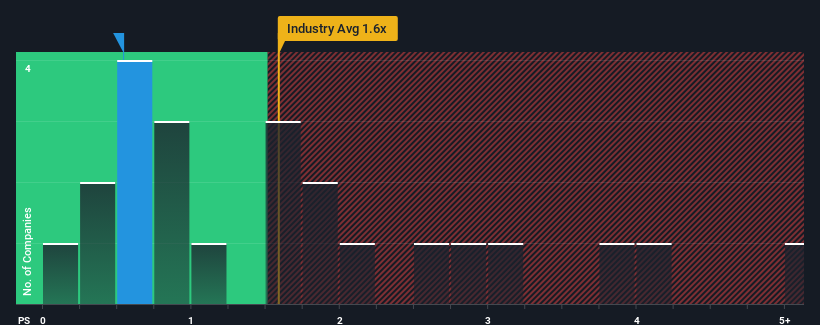

Since its price has dipped substantially, considering around half the companies operating in China's Auto industry have price-to-sales ratios (or "P/S") above 1.6x, you may consider Anhui Jianghuai Automobile GroupLtd as an solid investment opportunity with its 0.5x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Anhui Jianghuai Automobile GroupLtd Has Been Performing

Recent times have been advantageous for Anhui Jianghuai Automobile GroupLtd as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Anhui Jianghuai Automobile GroupLtd will help you uncover what's on the horizon.How Is Anhui Jianghuai Automobile GroupLtd's Revenue Growth Trending?

Anhui Jianghuai Automobile GroupLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Anhui Jianghuai Automobile GroupLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 3.0% over the next year. Meanwhile, the rest of the industry is forecast to expand by 51%, which is noticeably more attractive.

With this in consideration, its clear as to why Anhui Jianghuai Automobile GroupLtd's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Anhui Jianghuai Automobile GroupLtd's P/S

Anhui Jianghuai Automobile GroupLtd's recently weak share price has pulled its P/S back below other Auto companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Anhui Jianghuai Automobile GroupLtd's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Anhui Jianghuai Automobile GroupLtd with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.