The Caissa Tosun Development Co.,Ltd. (SZSE:000796) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 49% in that time.

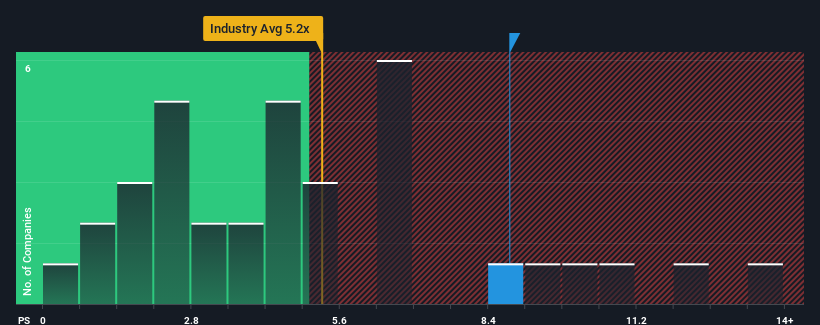

In spite of the heavy fall in price, Caissa Tosun DevelopmentLtd's price-to-sales (or "P/S") ratio of 8.8x might still make it look like a strong sell right now compared to other companies in the Hospitality industry in China, where around half of the companies have P/S ratios below 5.2x and even P/S below 2x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Has Caissa Tosun DevelopmentLtd Performed Recently?

With revenue growth that's inferior to most other companies of late, Caissa Tosun DevelopmentLtd has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Caissa Tosun DevelopmentLtd's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Caissa Tosun DevelopmentLtd's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. Still, revenue has fallen 79% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 411% as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 37% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Caissa Tosun DevelopmentLtd's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Even after such a strong price drop, Caissa Tosun DevelopmentLtd's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Caissa Tosun DevelopmentLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Hospitality industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Caissa Tosun DevelopmentLtd that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.