China Dredging Environment Protection Holdings Limited (HKG:871) shares have retraced a considerable 37% in the last month, reversing a fair amount of their solid recent performance. Longer-term, the stock has been solid despite a difficult 30 days, gaining 13% in the last year.

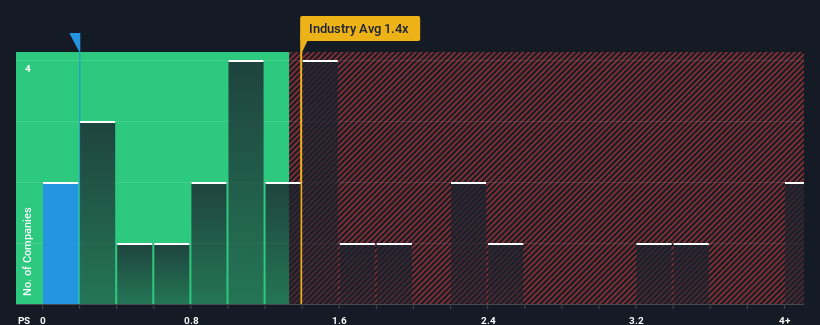

Since its price has dipped substantially, considering around half the companies operating in Hong Kong's Infrastructure industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider China Dredging Environment Protection Holdings as an solid investment opportunity with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has China Dredging Environment Protection Holdings Performed Recently?

China Dredging Environment Protection Holdings has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on China Dredging Environment Protection Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as China Dredging Environment Protection Holdings' is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as China Dredging Environment Protection Holdings' is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.9% last year. The latest three year period has also seen an excellent 49% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's about the same on an annualised basis.

With this information, we find it odd that China Dredging Environment Protection Holdings is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Bottom Line On China Dredging Environment Protection Holdings' P/S

China Dredging Environment Protection Holdings' recently weak share price has pulled its P/S back below other Infrastructure companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of China Dredging Environment Protection Holdings revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. medium-term

You should always think about risks. Case in point, we've spotted 2 warning signs for China Dredging Environment Protection Holdings you should be aware of, and 1 of them shouldn't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.