Unfortunately for some shareholders, the SKSHU Paint Co.,Ltd. (SHSE:603737) share price has dived 27% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 64% share price decline.

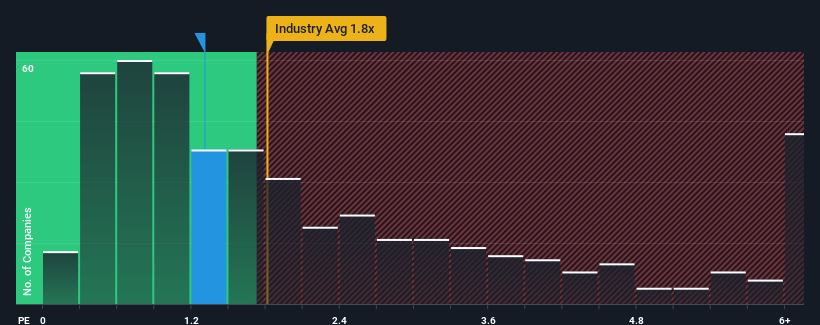

In spite of the heavy fall in price, SKSHU PaintLtd's price-to-sales (or "P/S") ratio of 1.3x might still make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 1.8x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does SKSHU PaintLtd's P/S Mean For Shareholders?

SKSHU PaintLtd certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SKSHU PaintLtd.How Is SKSHU PaintLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as SKSHU PaintLtd's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. The latest three year period has also seen an excellent 80% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 25% during the coming year according to the analysts following the company. With the industry predicted to deliver 26% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that SKSHU PaintLtd's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does SKSHU PaintLtd's P/S Mean For Investors?

SKSHU PaintLtd's recently weak share price has pulled its P/S back below other Chemicals companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of SKSHU PaintLtd's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for SKSHU PaintLtd you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.