No-one enjoys it when they lose money on a stock. But it's hard to avoid some disappointing investments when the overall market is down. While the Grandblue Environment Co., Ltd. (SHSE:600323) share price is down 31% in the last three years, the total return to shareholders (which includes dividends) was -28%. And that total return actually beats the market decline of 31%. Furthermore, it's down 16% in about a quarter. That's not much fun for holders. But this could be related to the weak market, which is down 21% in the same period.

After losing 6.4% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate three years of share price decline, Grandblue Environment actually saw its earnings per share (EPS) improve by 13% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

During the unfortunate three years of share price decline, Grandblue Environment actually saw its earnings per share (EPS) improve by 13% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

With a rather small yield of just 1.5% we doubt that the stock's share price is based on its dividend. Revenue is actually up 20% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Grandblue Environment further; while we may be missing something on this analysis, there might also be an opportunity.

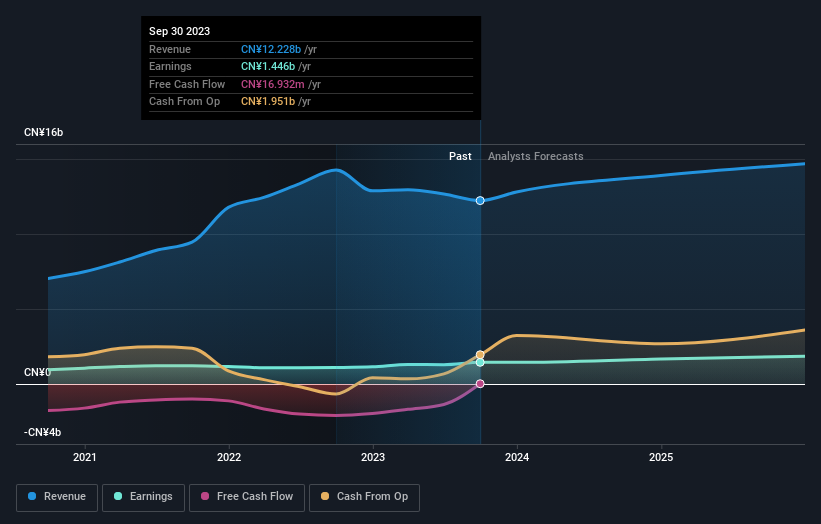

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Grandblue Environment has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Grandblue Environment's TSR for the last 3 years was -28%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While it's never nice to take a loss, Grandblue Environment shareholders can take comfort that , including dividends,their trailing twelve month loss of 18% wasn't as bad as the market loss of around 28%. Longer term investors wouldn't be so upset, since they would have made 0.6%, each year, over five years. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Grandblue Environment you should be aware of, and 1 of them shouldn't be ignored.

Of course Grandblue Environment may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.