[Business Data]

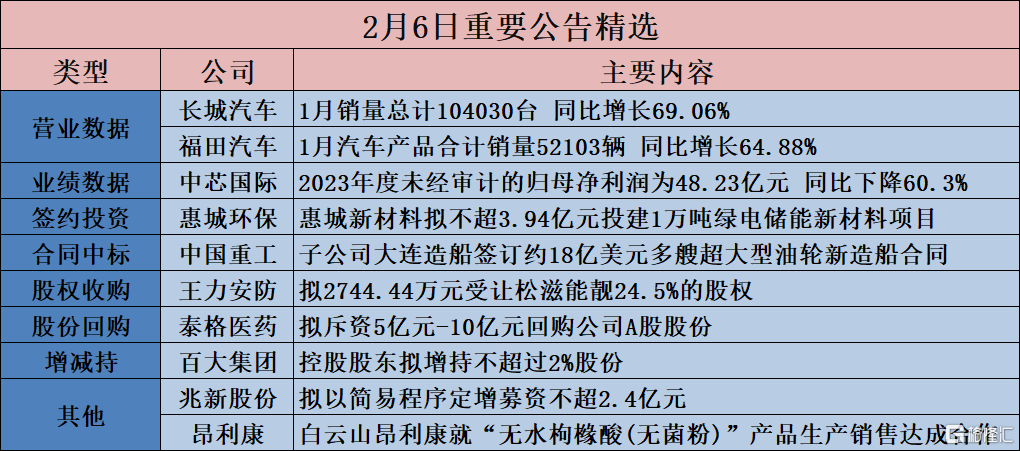

Great Wall Motor (601633.SH): Total sales volume of 10,4030 units in January increased 69.06% year over year

Great Wall Motors (601633.SH) announced its production and sales report for January 2024. The total sales volume for January was 104,030 units, up 69.06% year on year. In January, 26,374 units were sold overseas. In January, 25,030 new energy vehicles were sold.

Hefu China (603122.SH): Consolidated revenue of 95.7398 million yuan in January increased 13.58% year-on-year

Hefu China (603122.SH) announced that the company's consolidated revenue for January 2024 was RMB 95.7398 million, up 13.58% from the consolidated revenue for the same period last year.

Foton Motors (600166.SH): Total sales volume of automotive products in January was 52,103 vehicles, up 64.88% year-on-year

Foton Motors (600166.SH) released a quick report on production and sales data for various products for January. The total sales volume of automobile products was 52,103 vehicles, an increase of 64.88% over the previous year.

Dongfeng Motor (600006.SH): Total car sales volume of 1,5077 vehicles in January increased 175.73% year-on-year

Dongfeng Motor (600006.SH) released its January production and sales data report. Total vehicle sales volume was 15,077 vehicles, up 175.73% year on year.

[Investment projects]

Huicheng Environmental Protection (300779.SZ): Huicheng New Materials plans to invest no more than 394 million yuan to build a 10,000 ton green power energy storage new material project

Huicheng Environmental Protection (300779.SZ) announced that according to the development strategy and business needs of Qingdao Huicheng Environmental Technology Group Co., Ltd. (hereinafter referred to as the “Company”), the company's holding subsidiary Jiujiang Huicheng New Materials Co., Ltd. (“Huicheng New Materials”) plans to invest in the construction of a “10,000 ton green energy storage new material project” in Ruichang City, Jiangxi Province, with a total planned investment of no more than 394 million yuan.

Guiyan Platinum Industry (600459.SH): Guiyan Functional Company plans to invest about 432 million yuan to build an industrialization project for advanced processing and intelligent upgrading of new functional materials for precious metal alloys

Guiyan Platinum (600459.SH) announced that in order to further promote the development of the precious metal alloy functional new materials business, Guiyan Functional Materials (Yunnan) Co., Ltd. (“Guiyan Functional Company”), a wholly-owned subsidiary of the company, plans to invest in the construction of advanced processing and intelligent upgrading industrialization projects for new precious metal alloy functional materials to promote industrial production, expansion, transformation and upgrading, and continuously improve the quality and efficiency of development. The total investment of the project is about 432 million yuan.

Guangxi Energy (600310.SH): Plans to invest 767 million yuan to build the Eight-Step Renyi Wind Farm Project

Guangxi Energy (600310.SH) announced that in order to seize the development opportunities of the country to achieve the dual carbon target and vigorously develop the new energy industry, focus on the main business, actively explore and develop the new energy business, develop and expand the company's main electricity business, and cultivate new power points and profit growth points, Guangxi Energy Co., Ltd. plans to invest 767 million yuan (total dynamic investment) to build the Eight-Step Renyi Wind Farm Project.

Harbin Air Conditioning (600202.SH): Yizheng Yonghui plans to invest about 164 million yuan to build a new energy material and supporting project with an annual output of 1.2 million units (Phase I)

Harbin Air Conditioning (600202.SH) announced that Yizheng Yonghui, a holding subsidiary of the company, plans to invest in the construction of a new energy material and supporting project with an annual output of 1.2 million units (phase 1) (hereinafter referred to as “this project”) in Yizheng City, with an investment amount of about RMB 164 million (estimated, uncertain). Yizheng Yonghui's main business is automobile radiator manufacturing and sales; heat dissipation parts processing; manufacturing and sales of automobile radiators, cooling accessories, heat exchange equipment, aluminum tubes and aluminum profiles; manufacturing and sales of automobile radiators, cooling accessories, heat exchange equipment, aluminum tubes and aluminum profiles; manufacturing and sales of automotive radiators, cooling accessories, heat exchange equipment, aluminum tubes and aluminum profiles; Import and export business .

Zhongbei Communications (603220.SH): Plans to invest no more than 800 million yuan in power battery and energy storage system projects

Zhongbei Communications (603220.SH) announced that the company plans to invest in a power battery and energy storage system project. The project plans to build a new plant, warehouse and supporting facilities, and purchase advanced production, testing and other equipment. After completion, the project will develop an annual production capacity of 5 GWh lithium-ion power batteries and energy storage systems. The total investment amount of this project is no more than 800 million yuan, mainly including construction projects, equipment purchase and installation, engineering construction and others, preparation costs, and groundbreaking capital.

China Bay Communications (603220.SH): Plans to invest no more than 3 billion yuan in the intelligent computing center construction project

China Bay Communications (603220.SH) announced that the company plans to invest in an intelligent computing center construction project. The project plans to build computing power clusters in many places to provide customers with computing power services. The total investment amount of this project is no more than 3 billion yuan, which mainly includes expenses such as software and hardware purchases, site and supporting investments.

[Contract won the bid]

China Heavy Industries (601989.SH): Subsidiary Dalian Shipbuilding signs new shipbuilding contracts for more than 1.8 billion US dollars for more than large tankers

China Heavy Industries (601989.SH) announced that Dalian Shipbuilding Industry Group Co., Ltd. (“Dalian Shipbuilding”), a wholly-owned subsidiary of the company, has each signed a number of new very large tanker (VLCC) shipbuilding contracts with two well-known European shipowners, including 6+2 convention-fuel VLCCs and 4+2 LNG dual-fuel powered VLCCs, with a total contract amount close to 1.8 billion US dollars. The new VLCC shipbuilding contracts for the above 10 VLCCs came into effect when they were signed, and the other 4 VLCCs were option contracts. The contract was paid in US dollars, and the total contract amount accounted for about 29% of the company's 2022 audited revenue (calculated at the exchange rate of February 6, 2024).

[[Share acquisition]

Huawen Group (000793.SZ): Plans to transfer 55% of Hainan Cultural Tourism's shares

Huawen Group (000793.SZ) announced that the board of directors requested the company's shareholders' meeting to authorize the management team to publicly list and transfer 55% of the shares of Hainan Cultural and Creative Tourism Industrial Park Group Co., Ltd. (“Hainan Cultural Tourism”) (corresponding paid-up registered capital of 385.0 million yuan) through the property rights exchange. According to the evaluation results, it was determined that the initial listing price was not less than 35.2 million yuan.

Anoch (300067.SZ): Proposes to acquire 100% of Shanghai Gencong's shares

Anoch (300067.SZ) announced that the company signed a “Letter of Intent to Acquire Shares” with shareholders Guo Yapeng, Wu Ziyu, Song Fengyan, Shanghai Zhihong Tongzhou Enterprise Consulting Partnership (limited partnership), and Shanghai Zhihong Tongchuang Information Consulting Service Partnership (limited partnership), and Shanghai Zhihong Tongchuang Information Consulting Service Partnership (limited partnership). The company plans to purchase 100% of the shares of the target company held by the transferor through cash payment. After the acquisition is completed, the company will become the controlling shareholder of the target company, and the target company will be included in the scope of the company's consolidated statements. The purchase price is not to exceed RMB 100 million.

Wang Li Security (605268.SH): Plans to transfer 24.5% of Song Zineng's shares for 274.44,400 yuan

Wang Li Security (605268.SH) announced that the company plans to use its own capital of 274.44,400 yuan to transfer 24.5% of the shares of Songzi Nengliang New Material Technology Co., Ltd. (referred to as “Nengliang New Materials” and “Songzi Nengliang”) held by the minority shareholder Songzi Nengliang Building Materials Co., Ltd. (“Running Song”). After the transaction was completed, the company's shareholding ratio of Nengliang New Materials increased from 51% to 75.5%. Nengliang New Materials is still a holding subsidiary of the company, and the scope of the company's consolidated statements will not change.

[Performance data]

Bowling Bao (002286.SZ): Net profit in 2023 fell 59.47% year-on-year, and plans to pay 10 to 0.8 yuan

Bowling Bao (002286.SZ) announced its 2023 annual report. Operating income was 2.52 billion yuan, down 6.96% year on year, net profit of 59.47% year on year, after deducting non-net profit of 34.94 million yuan, down 71.84% year on year, basic earnings per share of 0.15 yuan. It plans to distribute a discovery dividend of 0.8 yuan for every 10 shares to all shareholders.

SMIC (688981.SH): Unaudited net profit to mother in 2023 was 4.823 billion yuan, a year-on-year decrease of 60.3%

SMIC (688981.SH) announced its results report for the fourth quarter of 2023. During the reporting period for the fourth quarter of 2023, the company achieved operating revenue of RMB 12.152 billion, an increase of 3.4% over the same period of the previous year; net profit attributable to shareholders of listed companies was RMB 1,148 billion, down 58.2% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was RMB 8.147 billion, down 54.8% year on year; and basic earnings per share were 0.14 yuan. Gross profit was RMB 2,288 billion, and gross margin was 18.8%.

Unaudited revenue for 2023 was RMB 45.250 billion, and revenue for the previous year was RMB 49.516 billion, down 8.6% year on year. Unaudited net profit attributable to shareholders of listed companies in 2023 was RMB 4,822.8 billion, and net profit attributable to shareholders of listed companies in the previous year was RMB 12.133.1 billion, down 60.3% from the previous year. In 2023, unaudited net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was RMB 3,269.5 billion, while net profit attributable to shareholders of listed companies after deduction of non-recurring profit and loss in the previous year was RMB 9.764.4 billion, down 66.5% from the previous year.

Chengyitong (300430.SZ): Net profit is expected to increase 17.07%-49.94% year-on-year in 2023

Chengyitong (300430.SZ) announced that it expects net profit of 146 million yuan to 187 million yuan in 2023, up 17.07%-49.94% from the same period last year, after deducting non-net profit of 121 million yuan to 162 million yuan, an increase of 6.40%-42.45% over the same period last year.

[Repurchase]

Tiger Pharmaceuticals (300347.SZ): Plans to spend 500 million yuan to 1 billion yuan to buy back the company's A shares

Tiger Pharmaceuticals (300347.SZ) announced that the company plans to use its own funds or self-raised funds to repurchase some of the company's A shares through centralized bidding transactions or other methods permitted by laws and regulations to later implement the A-share incentive plan or A-share employee stock ownership plan and reduce the company's registered capital. The total repurchase capital shall not be less than RMB 500 million and not more than RMB 1 billion; the repurchase price shall not exceed RMB 60.00 per share (including RMB 60.00 per share).

Yaxia Co., Ltd. (002375.SZ): Plans to spend 100 million yuan to 200 million yuan to buy back the company's shares

Yaxia Co., Ltd. (002375.SZ) announced that in order to protect the company's value and shareholders' rights, the company plans to use its own funds to repurchase the company's shares through centralized bidding transactions. The total repurchase amount is not less than RMB 100 million (including the principal amount) and no more than RMB 200 million (including the number of shares), and the repurchase price will not exceed 6.36 yuan/share (including the number of shares).

Guangpu Co., Ltd. (300632.SZ): Plans to spend 100 million yuan to 200 million yuan to buy back the company's shares

Guangpu Co., Ltd. (300632.SZ) announced that the company plans to use its own funds or self-raised funds to repurchase the company's shares through centralized bidding transactions to protect the company's value and shareholders' rights. Taking into account the company's financial situation, operating conditions and future profitability, the total capital of this repurchase is not less than 100 million yuan (inclusive) and no more than 200 million yuan (inclusive), and the repurchased share price is not more than RMB 12.00 per share (inclusive).

Blue Bird Fire (002960.SZ): Plans to spend 100 million yuan to 200 million yuan to buy back the company's shares

Blue Bird Fire (002960.SZ) announced that the company plans to repurchase shares for employee stock ownership plans or equity incentives; the total amount of the proposed repurchase capital shall not be less than RMB 100 million (inclusive) and not more than RMB 200 million (inclusive); and the proposed repurchase price shall not exceed RMB 15 yuan/share.

Shede Liquor (600702.SH): Plans to spend 100 million yuan to 200 million yuan to buy back the company's shares

Shede Liquor (600702.SH) announced that the company is now promoting a plan to “improve quality, increase efficiency and return” and repurchase the company's shares through centralized bidding transactions. It plans to repurchase shares for the company's employee stock ownership plans or equity incentives. The total capital to be repurchased is not less than RMB 100 million (inclusive) and not more than RMB 200 million (inclusive). The repurchase price does not exceed RMB 131.00 per share (inclusive). The repurchase period shall not exceed 6 months from the date the board of directors of the company reviewed and approved the share repurchase plan.

Kangyuan Pharmaceutical (600557.SH): plans to repurchase 150 million yuan to 300 million yuan of company shares

Kangyuan Pharmaceutical (600557.SH) announced that it plans to repurchase the company's shares with a total capital of not less than RMB 150 million and no more than RMB 300 million. The maximum repurchase price is RMB 18 per share.

China Software (600536.SH): plans to spend 100 million yuan to 200 million yuan to buy back the company's shares

China Software (600536.SH) announced that the company plans to buy back the company's issued RMB common shares (A shares) through centralized bidding transactions, taking into account factors such as the current operating situation, financial situation, and future profitability, in order to protect the company's value and shareholders' rights or use them for equity incentives. The number of shares to be repurchased is not less than 3,0303 million shares, of which 50% is to maintain the value of the company and 50% is used for equity incentives; the total capital to be repurchased is not less than 100 million yuan, not more than 200 million yuan, and the price of the shares to be repurchased is not higher than 33 yuan/share (inclusive). The period for which shares are to be repurchased is within 3 months from the date the shareholders' meeting deliberates and approves the repurchase plan.

[Increase or decrease holdings]

Guang'an Aizhong (600979.SH): The controlling shareholder plans to increase the company's shares by 30 million yuan to 60 million yuan

Guang'an Aizhong (600979.SH) announced that the controlling shareholder of the company, Sichuan Aizhong Development Group Co., Ltd. (hereinafter referred to as “Aizhong Group”), plans to increase its shareholding by no less than 30 million yuan or 60 million yuan within 6 months from the date of this announcement through the Shanghai Stock Exchange secondary market bidding transactions.

Baida Group (600865.SH): Controlling shareholders plan to increase their holdings by no more than 2%

Baida Group (600865.SH) announced that on February 6, 2024, the holding stock Dongzi International Holdings Co., Ltd. (“Xizi International”) used its own capital of about RMB 15.9.68 million to increase its A-share holdings through centralized bidding through the Shanghai Stock Exchange trading system to a total of 2,800,127 shares, accounting for 0.74% of the company's total issued shares. Within the next 6 months (starting from the date of this increase in holdings), Xizi International plans to continue to increase its A-share holdings through the Shanghai Stock Exchange trading system through centralized bidding, with a cumulative increase of no more than 3,762,400 shares and no more than 7,524,800 shares (including the shares already increased in this announcement). The cumulative increase in holdings will not exceed 2% of the total number of shares issued by the company. There is no price range for this increase in holdings. Xizi International will gradually implement a plan to increase its holdings based on a reasonable judgment on the company's stock price and according to the overall trend in the securities market.

Baoguang Co., Ltd. (600379.SH): The controlling shareholder increased its total shareholding by 2.9975%

Baoguang Co., Ltd. (600379.SH) announced that the company received the controlling shareholder Baoguang Group's “Notice on Increasing Shares”: Baoguang Group increased its total shareholding of 9,897,974 shares through centralized bidding transactions between February 5, 2024 and February 6, 2024. The number of additional shares held reached 2.9975% of the company's total share capital. After the increase in holdings, Baoguang Group held 98,935,784 shares of the Company, accounting for 29.9622% of the total share capital of the Company.

Fuchun Dyeing & Weaving (605189.SH): Actual controller He Biyu plans to increase shares by 3 million yuan to 5 million yuan

Fuchun Dyeing & Weaving (605189.SH) announced that Ms. He Biyu, the actual controller of the company, plans to use her own funds to increase her shareholding through centralized bidding transactions through the Shanghai Stock Exchange system. The amount of additional shares this time is not less than RMB 3 million, not more than RMB 5 million. The plan to increase holdings will be completed within 6 months from February 7, 2024.

Daye Co., Ltd. (300879.SZ): Actual controller Ye Xiaobo plans to increase the company's shares by 15 million yuan to 30 million yuan

Daye Co., Ltd. (300879.SZ) announced that based on recognition of the intrinsic value of Ningbo Daye Garden Equipment Co., Ltd. (the “Company”) and firm confidence in its continued stable and healthy future development, as well as safeguarding shareholders' interests and enhancing investor confidence, Mr. Ye Xiaobo, the actual controller of the company, plans to increase his holdings in the company within 6 months from the date of the announcement of this increase plan. The amount of this holdings increase plan is not less than RMB 15 million (inclusive) and no more than RMB 30 million (inclusive). The current holdings increase plan does not set a price range; the current holdings increase plan will be implemented based on the company's stock price fluctuations and overall capital market trends.

[Other]

Zhaoxin Co., Ltd. (002256.SZ): It is intended to raise no more than 240 million yuan in capital for Hexian integrated photovoltaic storage and charging and distributed photovoltaic power generation projects, etc. through simple procedures

Zhaoxin Co., Ltd. (002256.SZ) announced plans to issue A-shares to specific targets in 2024 using a simple procedure. The number of shares to be issued is determined by dividing the total amount of capital raised by the issuance price, and does not exceed 30% of the total share capital of the company before issuance. The total capital raised in this issue of shares is no more than RMB 300 million and no more than 20% of net assets at the end of the most recent year. The total amount of capital raised this time is no more than 240 million yuan (including capital). The net amount of capital raised after deducting issuance fees will be used for Hexian integrated photovoltaic storage and charging and distributed photovoltaic power generation projects, 1GW “sector interconnection” BIPV photovoltaic module projects with an annual output of 1 GW, additional working capital, and debt repayment.

Anglikang (002940.SZ): Cooperation reached with Baiyunshan Anglikang on the production and sale of “anhydrous citric acid (sterile powder)” products

<委托生产技术协议>Anglikang (002940.SZ) announced that the 35th meeting of the third board of directors of the company reviewed and passed the “Proposal on Signing and Related Transactions between the Company and Related Parties”. The company and Zhejiang Baiyunshan Anglikang Pharmaceutical Co., Ltd. (“Baiyunshan Anglikang” for short) reached cooperation on the production and sale of “anhydrous citric acid (sterile powder)” products.