One thing we could say about the analysts on Amlogic (Shanghai) Co.,Ltd. (SHSE:688099) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analysts seeing grey clouds on the horizon. At CN¥48.30, shares are up 7.2% in the past 7 days. It will be interesting to see if this downgrade motivates investors to start selling their holdings.

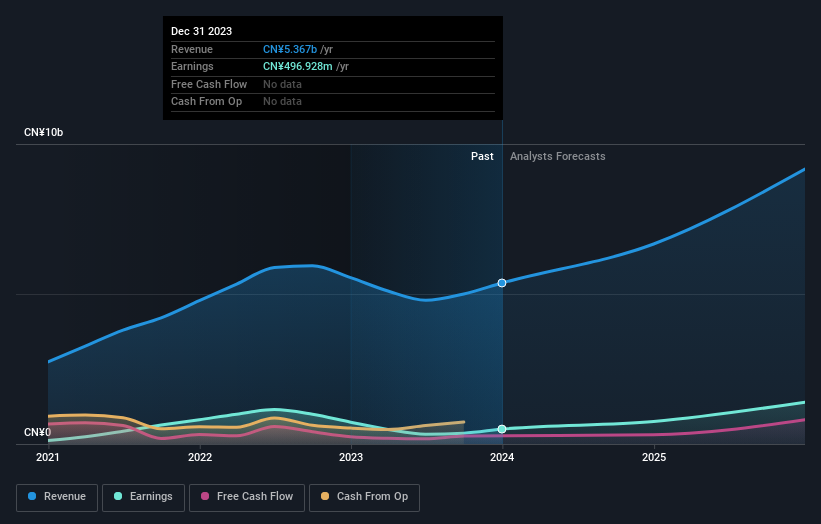

Following the downgrade, the latest consensus from Amlogic (Shanghai)Ltd's seven analysts is for revenues of CN¥6.7b in 2024, which would reflect a major 24% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to bounce 50% to CN¥1.80. Prior to this update, the analysts had been forecasting revenues of CN¥7.5b and earnings per share (EPS) of CN¥2.46 in 2024. Indeed, we can see that the analysts are a lot more bearish about Amlogic (Shanghai)Ltd's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

Analysts made no major changes to their price target of CN¥97.27, suggesting the downgrades are not expected to have a long-term impact on Amlogic (Shanghai)Ltd's valuation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The period to the end of 2024 brings more of the same, according to the analysts, with revenue forecast to display 24% growth on an annualised basis. That is in line with its 21% annual growth over the past five years. Juxtapose this against our data, which suggests that other companies (with analyst coverage) in the industry are forecast to see their revenues grow 24% per year. So although Amlogic (Shanghai)Ltd is expected to maintain its revenue growth rate, it's only growing at about the rate of the wider industry.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The period to the end of 2024 brings more of the same, according to the analysts, with revenue forecast to display 24% growth on an annualised basis. That is in line with its 21% annual growth over the past five years. Juxtapose this against our data, which suggests that other companies (with analyst coverage) in the industry are forecast to see their revenues grow 24% per year. So although Amlogic (Shanghai)Ltd is expected to maintain its revenue growth rate, it's only growing at about the rate of the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Lamentably, they also downgraded their sales forecasts, but the business is still expected to grow at roughly the same rate as the market itself. We're also surprised to see that the price target went unchanged. Still, deteriorating business conditions (assuming accurate forecasts!) can be a leading indicator for the stock price, so we wouldn't blame investors for being more cautious on Amlogic (Shanghai)Ltd after the downgrade.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Amlogic (Shanghai)Ltd analysts - going out to 2025, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.