Despite an already strong run, Suzhou TFC Optical Communication Co., Ltd. (SZSE:300394) shares have been powering on, with a gain of 36% in the last thirty days. The last month tops off a massive increase of 235% in the last year.

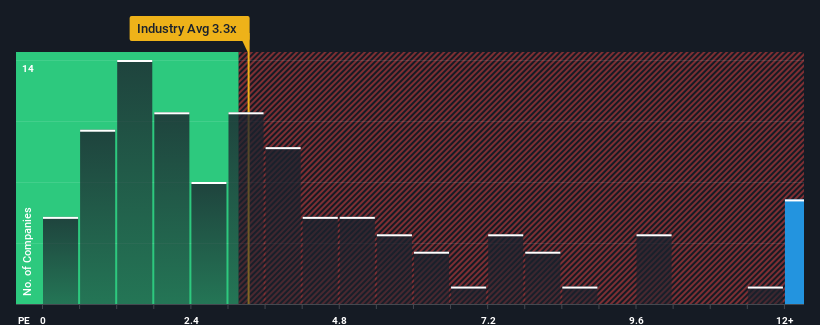

Following the firm bounce in price, given around half the companies in China's Communications industry have price-to-sales ratios (or "P/S") below 3.3x, you may consider Suzhou TFC Optical Communication as a stock to avoid entirely with its 29.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Suzhou TFC Optical Communication Has Been Performing

Recent times have been advantageous for Suzhou TFC Optical Communication as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Suzhou TFC Optical Communication.Is There Enough Revenue Growth Forecasted For Suzhou TFC Optical Communication?

The only time you'd be truly comfortable seeing a P/S as steep as Suzhou TFC Optical Communication's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 31% last year. The latest three year period has also seen an excellent 90% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 88% during the coming year according to the analysts following the company. With the industry only predicted to deliver 46%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Suzhou TFC Optical Communication's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Shares in Suzhou TFC Optical Communication have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Suzhou TFC Optical Communication's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Suzhou TFC Optical Communication.

If these risks are making you reconsider your opinion on Suzhou TFC Optical Communication, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.