历史不会简单的重复,但总押着相同的韵脚。

有“国家队”之称的中央汇金公司2月6日盘中发布公告称,充分认可当前A股市场配置价值,已于近日扩大交易型开放式指数基金(ETF)增持范围,并将持续加大增持力度、扩大增持规模,坚决维护资本市场平稳运行。

2月6日,沪深300ETF、上证50ETF、创业板ETF、中证500ETF、中证1000ETF基金均明显放量,成交额前十的指数ETF基金合计成交超460亿元,加上此前多日的交易情况来看,近一个月各类ETF基金累计成交额达数千亿元。

博时基金强调汇金及时出手并加大增持力度,一方面提供了流动性,同时也有利于快速扭转下跌预期、提振市场信心,使市场恢复平稳。

博时基金强调汇金及时出手并加大增持力度,一方面提供了流动性,同时也有利于快速扭转下跌预期、提振市场信心,使市场恢复平稳。

华福证券指出,随着政策效果陆续释放,行情有望企稳回升,而且无论从基本面流动性还是估值角度看,市场底部特征都非常明显:

1.上市公司业绩底大概率已经出现,2024年上市公司的盈利上行有望。2023年三季度A股上市公司单季净利润增速为2.2%,实现由负转正。从历史数据看,PPI同比增速与A股企业盈利高度相关,随着PPI同比增速的回升,价格因素对于企业盈利的压制逐步减弱,A股上市公司盈利上行有望。

2.当前A股整体估值已处于历史底部区域。截至2月6日,万得全A指数市盈率为15.05,市净率为1.33倍,均处于2010年至今历史底部区域。此外上证指数、沪深300、中证500等宽基指数估值同样处于2010年来历史低位水平。

3.流动性宽松,有望催化分母端行情。截至2月6日,1年期和10年期国债利率分别为1.88%和2.47%,处于2010年来历史低位,流动性宽松环境下有望催化分母端行情。

申万宏源研报指出,复盘市场历史大底,牛熊转化,本质上是市场驱动逻辑的切换,市场绝对低点的出现具有一定偶然性,微观结构的改善、利好事件的催化等都有可能成为触发因素;然而,市场走出底部的过程,需要有效改善的累积,包括基本面关键拐点的验证、改革线索的持续催化,一般而言还有新兴产业的催化;当前市场性价比已经来到历史级别高位,微观结构改善后,市场迎来超跌反弹的难度不大,但目前市场暂时不具备立即走出震荡市格局的线索。

历史不会简单的重复,但总押着相同的韵脚。在2015年股市大波动的时候,中央汇金公司也曾入市救场,在二级市场买入交易型开放式指数基金(ETF)。

民生证券复盘了2015年以证金公司、中央汇金为代表的平准力量入市:

2015年6月以来,受市场流动性压力的影响,万得全A在从6月中旬至7月初的下跌幅度一度超过40%。在这一进程中,以证金公司、中央汇金为代表的平准力量入市为A股提供流动性。

最初,平准资金的策略是增持大盘宽基ETF基金。中央汇金在2015年7月5日的公告中就曾明确表示:已于近期在二级市场买入ETF,并将继续相关的市场操作。

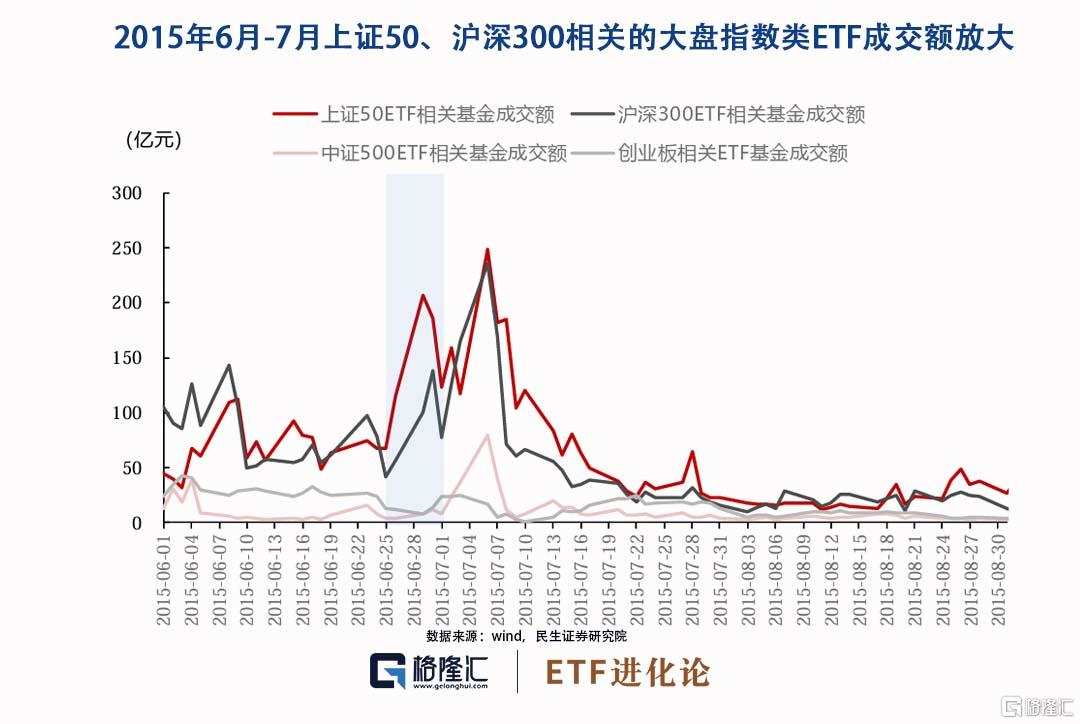

从ETF的成交情况来看,自2015年6月25日开始,上证50、沪深300相关的大盘指数类ETF的成交量有明显的扩张。

在2015年6月下旬,以创业板指、中证500指数、中证1000指数为代表的中小盘风格资产普遍表现不佳,但以中石油为代表的大盘权重股跌幅则相对较小,银行板块甚至逆势上涨。

在投资者对平准力量加大对小盘股流动性支持的呼声渐强后,平准资金的策略也开始发生变化,开始增加对中小盘风格资产的持仓。

2015年7月初开始,创业板指、中证1000指数相关ETF的成交量均有明显增长。此外,从2015年3季度证金公司和中央汇金对个股的持仓情况来看,在A股市场大幅调整期间的新增持仓中,沪深300指数成分股占比约75%,中证500、中证1000指数成分股及其他中小盘资产的占比约25%。

从市场表现来看,在2015年7月初平准资金开始加大对中小盘资产的持仓后,小盘风格的反弹幅度超过了大盘风格。

2015年平准资金大规模增持A股相关资产的过程大致在8月中旬告一段落。2015年8月14日,证监会发布公告明确指出“市场由剧烈异常波动逐步趋向常态化波动;未来证金公司稳定市场的职能不变,但一般不入市操作。”

值得注意的是,在平准力量对A股的影响逐步弱化后,当时投资者更偏好的中小市值资产并没有持续性地跑赢大盘股:在2015年8月和2016年1月初A股市场再次出现大幅波动的时期,以中证1000为代表的小市值风格资产的下跌幅度更大。

这种转变背后的真正原因是基本面发生的变化:在经过2014-2015年的供给出清和2016年的供给侧改革后,需求改善后行业龙头的价值逐步凸显;而在2014-2015年备受市场青睐、通过并购等方式转型涌入新兴行业小型公司反而在之后面临商誉减值等问题的困扰。

在市场经历了极端的情绪冲击后,中短期修复扭曲的估值,长期终归还是会回到基本面主导