To the annoyance of some shareholders, Business-intelligence of Oriental Nations Corporation Ltd. (SZSE:300166) shares are down a considerable 28% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 31% share price drop.

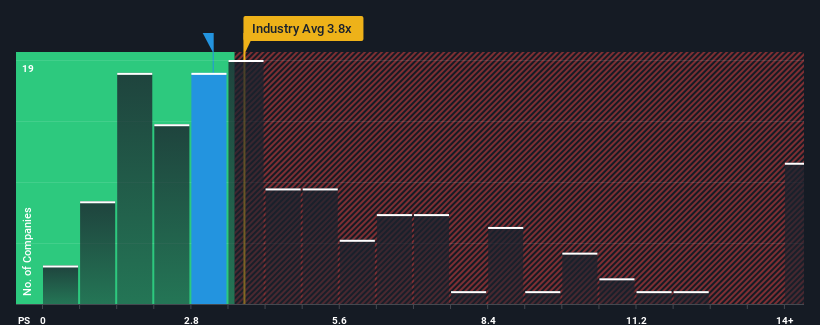

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Business-intelligence of Oriental Nations' P/S ratio of 3.2x, since the median price-to-sales (or "P/S") ratio for the Software industry in China is also close to 3.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Business-intelligence of Oriental Nations Has Been Performing

Business-intelligence of Oriental Nations could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Business-intelligence of Oriental Nations will help you uncover what's on the horizon.How Is Business-intelligence of Oriental Nations' Revenue Growth Trending?

In order to justify its P/S ratio, Business-intelligence of Oriental Nations would need to produce growth that's similar to the industry.

In order to justify its P/S ratio, Business-intelligence of Oriental Nations would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.6%. Regardless, revenue has managed to lift by a handy 5.1% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 20% as estimated by the dual analysts watching the company. With the industry predicted to deliver 34% growth, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Business-intelligence of Oriental Nations' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Business-intelligence of Oriental Nations' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at the analysts forecasts of Business-intelligence of Oriental Nations' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Business-intelligence of Oriental Nations with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.