Everest Group, Ltd. (NYSE:EG) Could Be Riskier Than It Looks

Everest Group, Ltd. (NYSE:EG) Could Be Riskier Than It Looks

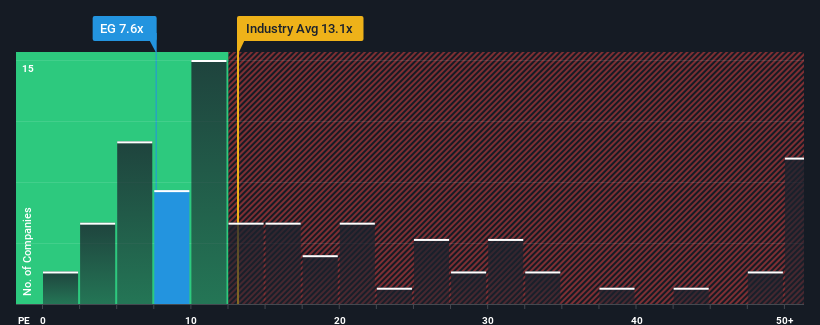

With a price-to-earnings (or "P/E") ratio of 7.6x Everest Group, Ltd. (NYSE:EG) may be sending very bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 31x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

珠穆朗玛峰集团有限公司(纽约证券交易所代码:EG)的市盈率(或 “市盈率”)为7.6倍,目前可能发出了非常看涨的信号,因为美国几乎有一半公司的市盈率大于17倍,甚至市盈率高于31倍也并不罕见。但是,市盈率可能很低是有原因的,需要进一步调查以确定其是否合理。

With its earnings growth in positive territory compared to the declining earnings of most other companies, Everest Group has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

与大多数其他公司的收益下降相比,其收益增长处于正值区间,珠穆朗玛峰集团最近表现良好。一种可能性是市盈率很低,因为投资者认为该公司的收益将像其他所有人一样很快下降。如果你喜欢这家公司,你希望情况并非如此,这样你就有可能在它失宠的时候买入一些股票。

NYSE:EG Price to Earnings Ratio vs Industry February 6th 2024

纽约证券交易所:EG 对比行业的市盈率 2024 年 2 月 6 日

Keen to find out how analysts think Everest Group's future stacks up against the industry? In that case, our free report is a great place to start.

想了解分析师如何看待珠穆朗玛峰集团的未来与该行业的对立吗?在这种情况下,我们的免费报告是一个很好的起点。

Is There Any Growth For Everest Group?

珠穆朗玛峰集团有增长吗?

The only time you'd be truly comfortable seeing a P/E as depressed as Everest Group's is when the company's growth is on track to lag the market decidedly.

只有当公司的增长有望明显落后于市场时,你才能真正放心地看到像珠穆朗玛峰集团一样低迷的市盈率。

If we review the last year of earnings growth, the company posted a terrific increase of 296%. Pleasingly, EPS has also lifted 204% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

如果我们回顾一下去年的收益增长,该公司公布了296%的惊人增长。令人高兴的是,由于过去12个月的增长,每股收益总额也比三年前增长了204%。因此,股东们可能会对这些中期收益增长率表示欢迎。

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 12% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 10% each year, which is noticeably less attractive.

展望未来,报道该公司的七位分析师的估计表明,未来三年收益将每年增长12%。同时,预计其余市场每年仅增长10%,吸引力明显降低。

In light of this, it's peculiar that Everest Group's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

有鉴于此,奇怪的是,珠穆朗玛峰集团的市盈率低于大多数其他公司。看来大多数投资者根本不相信公司能够实现未来的增长预期。

The Key Takeaway

关键要点

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

通常,在做出投资决策时,我们会谨慎行事,不要过多地阅读市盈率,尽管这可以充分揭示其他市场参与者对公司的看法。

Our examination of Everest Group's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

我们对珠穆朗玛峰集团分析师预测的审查显示,其优异的盈利前景对市盈率的贡献没有我们预期的那么大。可能存在一些未观察到的重大收益威胁,使市盈率无法与乐观的前景相吻合。看来许多人确实在预期收益不稳定,因为这些条件通常应该会提振股价。

We don't want to rain on the parade too much, but we did also find 1 warning sign for Everest Group that you need to be mindful of.

我们不想在游行队伍中下太多雨,但我们也为珠穆朗玛峰集团找到了一个需要注意的警告标志。

If these risks are making you reconsider your opinion on Everest Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果这些风险让你重新考虑你对珠穆朗玛峰集团的看法,请浏览我们的互动式高质量股票清单,了解还有什么。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接联系我们。或者,也可以发送电子邮件至编辑团队 (at) simplywallst.com。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

Keen to find out how analysts think Everest Group's future stacks up against the industry? In that case, our

Keen to find out how analysts think Everest Group's future stacks up against the industry? In that case, our