Jiangxi Guotai Group Co.,Ltd. (SHSE:603977) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 12% share price drop.

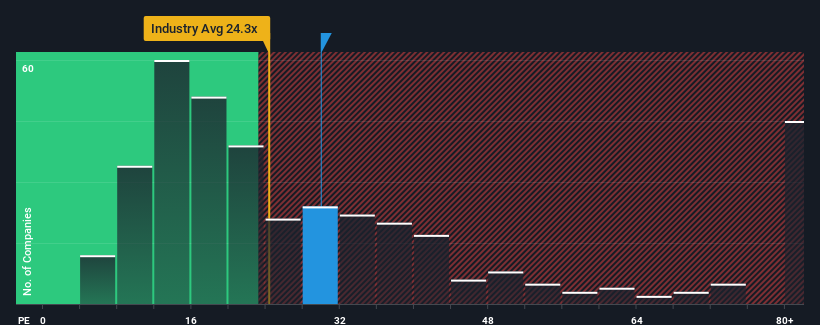

Even after such a large drop in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 25x, you may still consider Jiangxi Guotai GroupLtd as a stock to potentially avoid with its 29.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Jiangxi Guotai GroupLtd has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Jiangxi Guotai GroupLtd would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 45%. The last three years don't look nice either as the company has shrunk EPS by 12% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 115% during the coming year according to the two analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

With this information, we can see why Jiangxi Guotai GroupLtd is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Jiangxi Guotai GroupLtd's P/E hasn't come down all the way after its stock plunged. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Jiangxi Guotai GroupLtd maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Jiangxi Guotai GroupLtd you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.