Fullink Technology Co.,Ltd (SZSE:301067) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 14% share price drop.

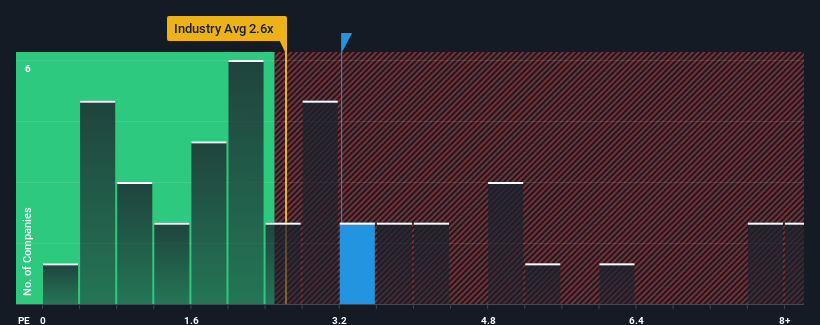

Although its price has dipped substantially, you could still be forgiven for thinking Fullink TechnologyLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.2x, considering almost half the companies in China's Tech industry have P/S ratios below 2.6x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Fullink TechnologyLtd Has Been Performing

As an illustration, revenue has deteriorated at Fullink TechnologyLtd over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Fullink TechnologyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Fullink TechnologyLtd's is when the company's growth is on track to outshine the industry.

The only time you'd be truly comfortable seeing a P/S as high as Fullink TechnologyLtd's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 17% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 29% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it worrying that Fullink TechnologyLtd's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Fullink TechnologyLtd's P/S Mean For Investors?

Despite the recent share price weakness, Fullink TechnologyLtd's P/S remains higher than most other companies in the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Fullink TechnologyLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Fullink TechnologyLtd (at least 2 which don't sit too well with us), and understanding these should be part of your investment process.

If you're unsure about the strength of Fullink TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.