The Guangdong Huafeng New Energy Technology Co.,Ltd. (SZSE:002806) share price has fared very poorly over the last month, falling by a substantial 50%. For any long-term shareholders, the last month ends a year to forget by locking in a 55% share price decline.

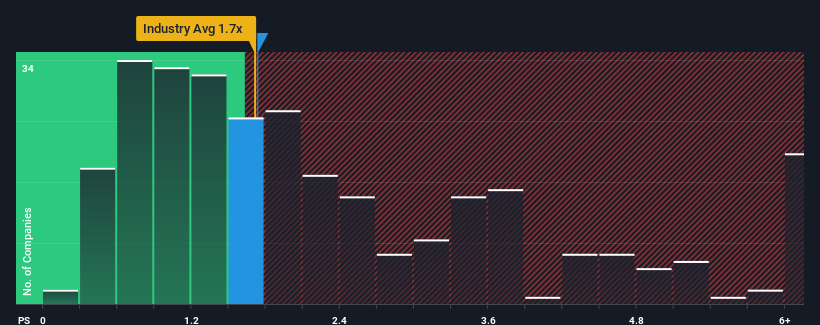

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Guangdong Huafeng New Energy TechnologyLtd's P/S ratio of 1.7x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in China is about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Guangdong Huafeng New Energy TechnologyLtd Has Been Performing

Revenue has risen at a steady rate over the last year for Guangdong Huafeng New Energy TechnologyLtd, which is generally not a bad outcome. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. Those who are bullish on Guangdong Huafeng New Energy TechnologyLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Guangdong Huafeng New Energy TechnologyLtd will help you shine a light on its historical performance.How Is Guangdong Huafeng New Energy TechnologyLtd's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Guangdong Huafeng New Energy TechnologyLtd's to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Guangdong Huafeng New Energy TechnologyLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 2.7%. The solid recent performance means it was also able to grow revenue by 19% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing that to the industry, which is predicted to deliver 26% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we find it interesting that Guangdong Huafeng New Energy TechnologyLtd is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

Guangdong Huafeng New Energy TechnologyLtd's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Guangdong Huafeng New Energy TechnologyLtd's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

It is also worth noting that we have found 3 warning signs for Guangdong Huafeng New Energy TechnologyLtd that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.