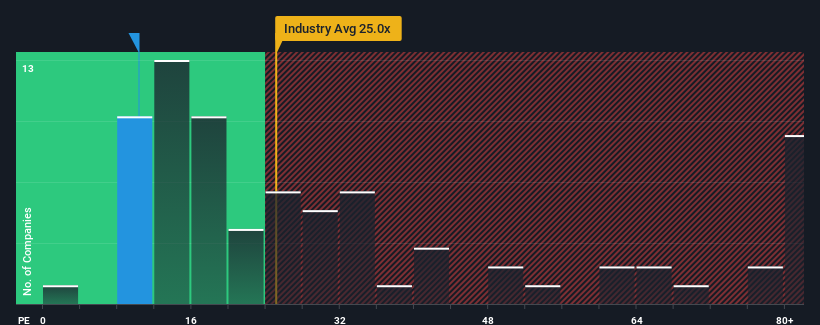

Central Plains Environment Protection Co.,Ltd.'s (SZSE:000544) price-to-earnings (or "P/E") ratio of 10.3x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 27x and even P/E's above 48x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings that are retreating more than the market's of late, Central Plains Environment ProtectionLtd has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Is There Any Growth For Central Plains Environment ProtectionLtd?

Central Plains Environment ProtectionLtd's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered a frustrating 5.2% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 5.0% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Retrospectively, the last year delivered a frustrating 5.2% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 5.0% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 74% as estimated by the lone analyst watching the company. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

With this information, we find it odd that Central Plains Environment ProtectionLtd is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Central Plains Environment ProtectionLtd's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Central Plains Environment ProtectionLtd currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Central Plains Environment ProtectionLtd (at least 1 which is potentially serious), and understanding them should be part of your investment process.

If you're unsure about the strength of Central Plains Environment ProtectionLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.