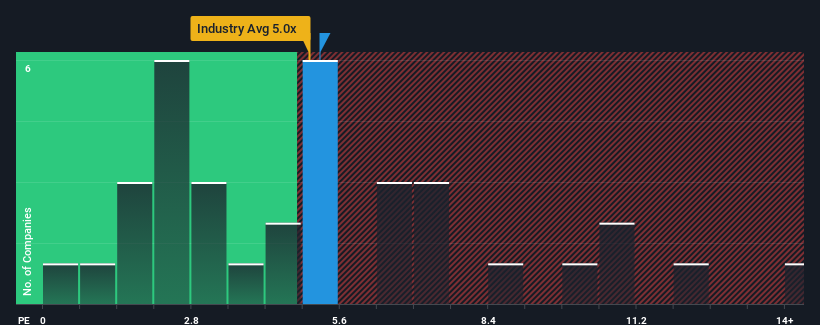

With a median price-to-sales (or "P/S") ratio of close to 5x in the Hospitality industry in China, you could be forgiven for feeling indifferent about Emei Shan Tourism Co.,Ltd's (SZSE:000888) P/S ratio of 5.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does Emei Shan TourismLtd's Recent Performance Look Like?

Emei Shan TourismLtd's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on Emei Shan TourismLtd will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Emei Shan TourismLtd?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Emei Shan TourismLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 87%. The latest three year period has also seen an excellent 51% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

If we review the last year of revenue growth, the company posted a terrific increase of 87%. The latest three year period has also seen an excellent 51% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 25% during the coming year according to the four analysts following the company. That's shaping up to be materially lower than the 37% growth forecast for the broader industry.

In light of this, it's curious that Emei Shan TourismLtd's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Emei Shan TourismLtd's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

When you consider that Emei Shan TourismLtd's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Emei Shan TourismLtd with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.