Kingkey Financial International (Holdings) Limited (HKG:1468) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 80% share price decline over the last year.

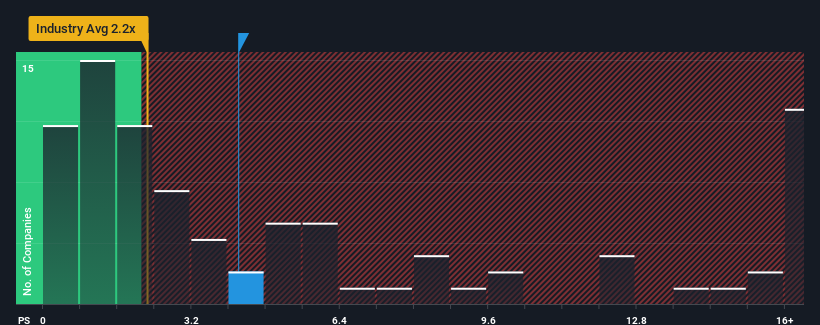

Since its price has surged higher, when almost half of the companies in Hong Kong's Capital Markets industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Kingkey Financial International (Holdings) as a stock probably not worth researching with its 4.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does Kingkey Financial International (Holdings)'s P/S Mean For Shareholders?

Kingkey Financial International (Holdings) certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Kingkey Financial International (Holdings)'s earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Kingkey Financial International (Holdings)?

The only time you'd be truly comfortable seeing a P/S as high as Kingkey Financial International (Holdings)'s is when the company's growth is on track to outshine the industry.

The only time you'd be truly comfortable seeing a P/S as high as Kingkey Financial International (Holdings)'s is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 222% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 268% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 37% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we can see why Kingkey Financial International (Holdings) is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On Kingkey Financial International (Holdings)'s P/S

The large bounce in Kingkey Financial International (Holdings)'s shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Kingkey Financial International (Holdings) revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Having said that, be aware Kingkey Financial International (Holdings) is showing 4 warning signs in our investment analysis, and 2 of those are significant.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.