Pubang Landscape Architecture Co., Ltd (SZSE:002663) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

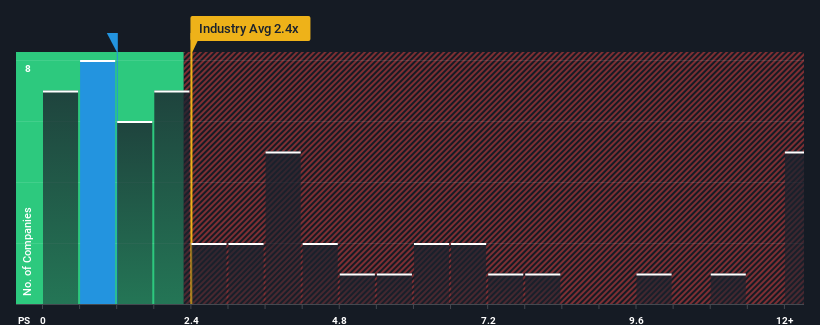

Following the heavy fall in price, Pubang Landscape Architecture may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.2x, considering almost half of all companies in the Professional Services industry in China have P/S ratios greater than 2.4x and even P/S higher than 6x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Pubang Landscape Architecture Performed Recently?

As an illustration, revenue has deteriorated at Pubang Landscape Architecture over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Pubang Landscape Architecture will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Pubang Landscape Architecture will help you shine a light on its historical performance.How Is Pubang Landscape Architecture's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Pubang Landscape Architecture's to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Pubang Landscape Architecture's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 9.0% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 13% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 94% shows it's an unpleasant look.

With this information, we are not surprised that Pubang Landscape Architecture is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On Pubang Landscape Architecture's P/S

The southerly movements of Pubang Landscape Architecture's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's no surprise that Pubang Landscape Architecture maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

You should always think about risks. Case in point, we've spotted 1 warning sign for Pubang Landscape Architecture you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.