One of the frustrations of investing is when a stock goes down. But it can difficult to make money in a declining market. The COSCO SHIPPING Development Co., Ltd. (HKG:2866) is down 39% over three years, but the total shareholder return is -14% once you include the dividend. That's better than the market which declined 36% over the last three years.

On a more encouraging note the company has added HK$406m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

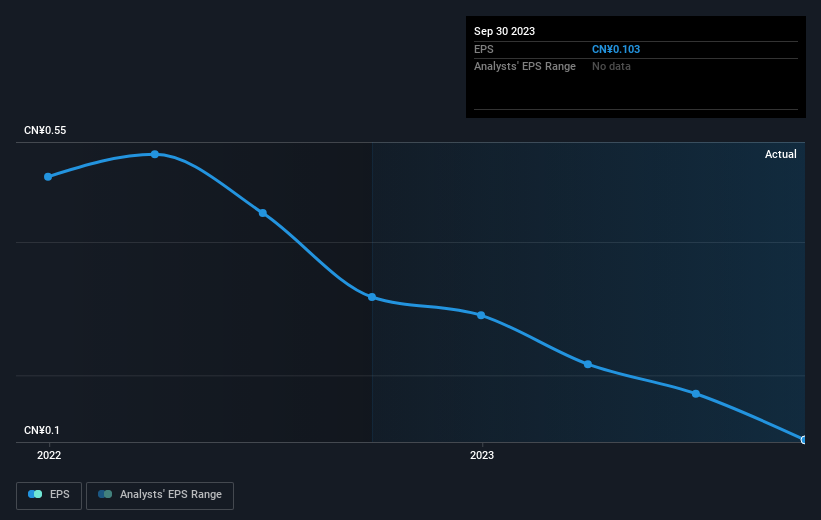

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years that the share price fell, COSCO SHIPPING Development's earnings per share (EPS) dropped by 9.5% each year. The share price decline of 15% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past. This increased caution is also evident in the rather low P/E ratio, which is sitting at 7.00.

During the three years that the share price fell, COSCO SHIPPING Development's earnings per share (EPS) dropped by 9.5% each year. The share price decline of 15% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past. This increased caution is also evident in the rather low P/E ratio, which is sitting at 7.00.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of COSCO SHIPPING Development's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of COSCO SHIPPING Development, it has a TSR of -14% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

The total return of 16% received by COSCO SHIPPING Development shareholders over the last year isn't far from the market return of -15%. The silver lining is that longer term investors would have made a total return of 4% per year over half a decade. If the fundamental data remains strong, and the share price is simply down on sentiment, then this could be an opportunity worth investigating. It's always interesting to track share price performance over the longer term. But to understand COSCO SHIPPING Development better, we need to consider many other factors. For example, we've discovered 3 warning signs for COSCO SHIPPING Development (1 is significant!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.