What Is Cohu, Inc.'s (NASDAQ:COHU) Share Price Doing?

What Is Cohu, Inc.'s (NASDAQ:COHU) Share Price Doing?

Cohu, Inc. (NASDAQ:COHU), is not the largest company out there, but it saw significant share price movement during recent months on the NASDAQGS, rising to highs of US$36.38 and falling to the lows of US$31.02. Some share price movements can give investors a better opportunity to enter into the stock, and potentially buy at a lower price. A question to answer is whether Cohu's current trading price of US$32.47 reflective of the actual value of the small-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let's take a look at Cohu's outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

Cohu, Inc.(纳斯达克股票代码:COHU)并不是目前最大的公司,但它在纳斯达克证券交易所的股价在最近几个月出现了大幅波动,升至36.38美元的高位,跌至31.02美元的低点。一些股价走势可以为投资者提供更好的入股机会,并有可能以较低的价格买入。需要回答的问题是,Cohu目前的32.47美元交易价格是否反映了小盘股的实际价值?还是它目前的估值被低估了,为我们提供了买入的机会?让我们根据最新的财务数据来看看Cohu的前景和价值,看看是否有任何价格变动的催化剂。

What's The Opportunity In Cohu?

Cohu 的机会是什么?

Cohu appears to be overvalued by 26% at the moment, based on our discounted cash flow valuation. The stock is currently priced at US$32.47 on the market compared to our intrinsic value of $25.83. Not the best news for investors looking to buy! But, is there another opportunity to buy low in the future? Given that Cohu's share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, which is a good indicator for share price volatility.

根据我们的折扣现金流估值,Cohu目前似乎被高估了26%。该股目前的市场定价为32.47美元,而我们的内在价值为25.83美元。对于想要买入的投资者来说,这不是最好的消息!但是,未来还有其他低价买入的机会吗?鉴于Cohu的股票波动性相当大(即其价格相对于其他市场的价格变动被放大),这可能意味着价格可能会下跌,从而为我们提供将来又一次买入的机会。这是基于其高贝塔值,这是衡量股价波动的良好指标。

Can we expect growth from Cohu?

我们可以期待 Cohu 的增长吗?

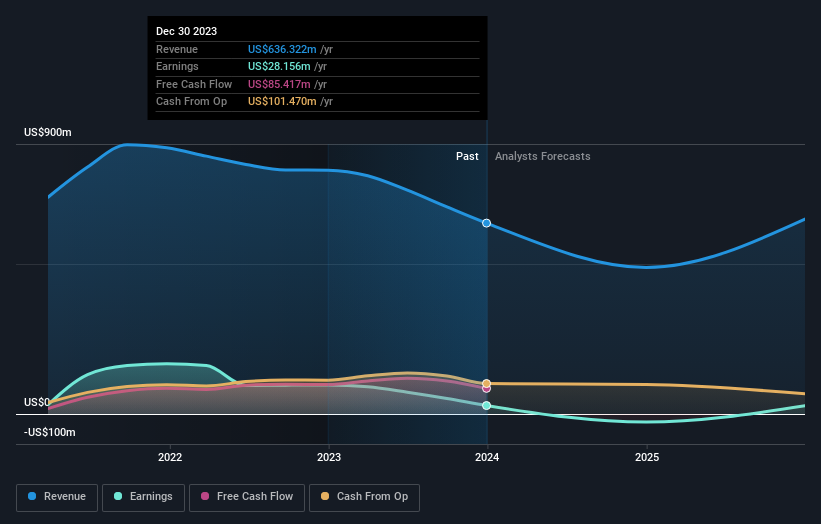

Future outlook is an important aspect when you're looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it's the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. However, with a negative profit growth of -4.0% expected over the next couple of years, near-term growth certainly doesn't appear to be a driver for a buy decision for Cohu. This certainty tips the risk-return scale towards higher risk.

当你考虑买入股票时,未来前景是一个重要的方面,特别是如果你是寻求投资组合增长的投资者。尽管价值投资者会争辩说,最重要的是相对于价格的内在价值,但更有说服力的投资论点是以低廉的价格获得高增长潜力。但是,预计未来几年利润将出现负增长-4.0%,因此短期增长显然不是Cohu做出买入决定的驱动力。这种确定性使风险回报规模朝着更高的风险方向发展。

What This Means For You

这对你意味着什么

Are you a shareholder? If you believe COHU is currently trading above its value, selling high and buying it back up again when its price falls towards its real value can be profitable. Given the uncertainty from negative growth in the future, this could be the right time to de-risk your portfolio. But before you make this decision, take a look at whether its fundamentals have changed.

你是股东吗?如果您认为COHU目前的交易价格高于其价值,那么高价卖出并在其价格跌至实际价值时再次回购可以获利。鉴于未来负增长带来的不确定性,这可能是降低投资组合风险的合适时机。但是在做出这个决定之前,先看看它的基本面是否发生了变化。

Are you a potential investor? If you've been keeping an eye on COHU for a while, now may not be the best time to enter into the stock. Its price has risen beyond its true value, on top of a negative future outlook. However, there are also other important factors which we haven't considered today, such as the track record of its management. Should the price fall in the future, will you be well-informed enough to buy?

你是潜在的投资者吗?如果你关注COHU已有一段时间了,那么现在可能不是入股的最佳时机。除了负面的未来前景外,其价格已超过其真实价值。但是,还有其他重要因素我们今天没有考虑,例如其管理的往绩。如果将来价格下跌,您是否足够了解情况,可以购买?

In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For instance, we've identified 2 warning signs for Cohu (1 shouldn't be ignored) you should be familiar with.

有鉴于此,如果你想对公司进行更多分析,了解所涉及的风险至关重要。例如,我们已经确定了你应该熟悉的 Cohu 的 2 个警告标志(1 个不容忽视)。

If you are no longer interested in Cohu, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

如果您不再对Cohu感兴趣,可以使用我们的免费平台查看我们列出的其他50多只具有高增长潜力的股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

Are you a shareholder? If you believe COHU is currently trading above its value, selling high and buying it back up again when its price falls towards its real value can be profitable. Given the uncertainty from negative growth in the future, this could be the right time to de-risk your portfolio. But before you make this decision, take a look at whether its fundamentals have changed.

Are you a shareholder? If you believe COHU is currently trading above its value, selling high and buying it back up again when its price falls towards its real value can be profitable. Given the uncertainty from negative growth in the future, this could be the right time to de-risk your portfolio. But before you make this decision, take a look at whether its fundamentals have changed.