Is Repare Therapeutics (NASDAQ:RPTX) In A Good Position To Deliver On Growth Plans?

Is Repare Therapeutics (NASDAQ:RPTX) In A Good Position To Deliver On Growth Plans?

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

我们可以很容易地理解为什么投资者会被无利可图的公司所吸引。例如,生物技术和矿业勘探公司通常会亏损多年,然后才通过新的治疗方法或矿物发现获得成功。但是,尽管成功是众所周知的,但投资者不应忽视许多无利可图的公司,这些公司只是耗尽了所有现金然后倒闭。

Given this risk, we thought we'd take a look at whether Repare Therapeutics (NASDAQ:RPTX) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

鉴于这种风险,我们想看看Repare Therapeutics(纳斯达克股票代码:RPTX)的股东是否应该担心其现金消耗。就本文而言,我们将现金消耗定义为公司每年为其增长提供资金的现金金额(也称为负自由现金流)。首先,我们将通过将其现金消耗与现金储备进行比较来确定其现金流道。

How Long Is Repare Therapeutics' Cash Runway?

Repare Therapeutics 的现金流有多长?

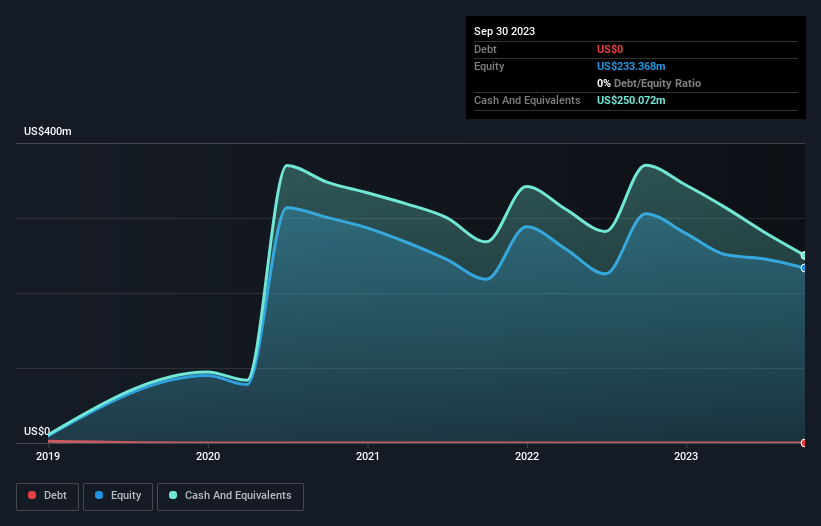

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When Repare Therapeutics last reported its balance sheet in September 2023, it had zero debt and cash worth US$250m. Importantly, its cash burn was US$128m over the trailing twelve months. Therefore, from September 2023 it had roughly 23 months of cash runway. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. You can see how its cash balance has changed over time in the image below.

你可以通过将公司的现金金额除以现金的支出率来计算公司的现金流量。Repare Therapeutics上次于2023年9月公布其资产负债表时,其负债为零,现金价值2.5亿美元。重要的是,在过去的十二个月中,其现金消耗为1.28亿美元。因此,从2023年9月起,它有大约23个月的现金流道。这还不错,但可以公平地说,除非现金消耗大幅减少,否则现金流的终结就在眼前。您可以在下图中看到其现金余额如何随着时间的推移而变化。

Is Repare Therapeutics' Revenue Growing?

Repare Therapeutics的收入在增长吗?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because Repare Therapeutics actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. The grim reality for shareholders is that operating revenue fell by 53% over the last twelve months, which is not what we want to see in a cash burning company. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

我们不愿推断最近的趋势来评估其现金消耗,因为Repare Therapeutics去年的自由现金流实际上为正,因此营业收入增长可能是我们目前衡量的最佳选择。股东面临的严峻现实是,在过去的十二个月中,营业收入下降了53%,这不是我们希望在现金消耗公司中看到的。但是,显然,关键因素是该公司未来是否会发展其业务。因此,你可能想看看该公司在未来几年预计将增长多少。

How Hard Would It Be For Repare Therapeutics To Raise More Cash For Growth?

Repare Therapeutics筹集更多现金促进增长会有多难?

Since its revenue growth is moving in the wrong direction, Repare Therapeutics shareholders may wish to think ahead to when the company may need to raise more cash. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

由于其收入增长正朝着错误的方向发展,Repare Therapeutics的股东们不妨提前考虑公司何时可能需要筹集更多资金。发行新股或承担债务是上市公司为其业务筹集更多资金的最常见方式。上市公司的主要优势之一是,它们可以向投资者出售股票以筹集现金和为增长提供资金。我们可以将公司的现金消耗与其市值进行比较,以了解公司必须发行多少新股才能为一年的运营提供资金。

Repare Therapeutics' cash burn of US$128m is about 46% of its US$279m market capitalisation. From this perspective, it seems that the company spent a huge amount relative to its market value, and we'd be very wary of a painful capital raising.

Repare Therapeutics的1.28亿美元现金消耗约占其2.79亿美元市值的46%。从这个角度来看,相对于市值,该公司的支出似乎相当巨大,我们会对痛苦的筹资活动保持警惕。

How Risky Is Repare Therapeutics' Cash Burn Situation?

Repare Therapeutics的现金消耗情况有多危险?

Even though its falling revenue makes us a little nervous, we are compelled to mention that we thought Repare Therapeutics' cash runway was relatively promising. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. On another note, Repare Therapeutics has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

尽管收入的下降使我们有些紧张,但我们不得不提到,我们认为Repare Therapeutics的现金流相对乐观。从这份简短报告中提到的因素来看,我们确实认为其现金消耗有点风险,而且确实使我们对该股有些紧张。另一方面,Repare Therapeutics有3个警告信号(还有一个有点不愉快),我们认为你应该知道。

Of course Repare Therapeutics may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

当然,Repare Therapeutics可能不是最好的买入股票。因此,你可能希望看到这份免费收藏的拥有高股本回报率的公司,或者这份内部人士正在购买的股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

We're hesitant to extrapolate on the recent trend to assess its cash burn, because Repare Therapeutics actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. The grim reality for shareholders is that operating revenue fell by 53% over the last twelve months, which is not what we want to see in a cash burning company. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

We're hesitant to extrapolate on the recent trend to assess its cash burn, because Repare Therapeutics actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. The grim reality for shareholders is that operating revenue fell by 53% over the last twelve months, which is not what we want to see in a cash burning company. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.