Zhejiang Juhua Co., Ltd. (SHSE:600160) shareholders have had their patience rewarded with a 28% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

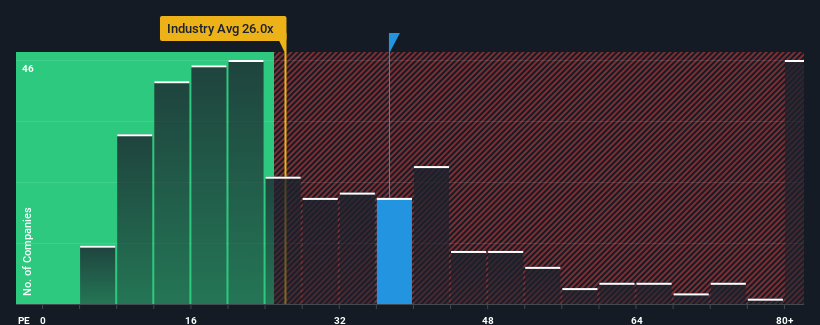

Since its price has surged higher, Zhejiang Juhua's price-to-earnings (or "P/E") ratio of 37.3x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 27x and even P/E's below 17x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Zhejiang Juhua has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Zhejiang Juhua's is when the company's growth is on track to outshine the market.

The only time you'd be truly comfortable seeing a P/E as high as Zhejiang Juhua's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a frustrating 44% decrease to the company's bottom line. Even so, admirably EPS has lifted 3,082% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 51% as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

In light of this, it's understandable that Zhejiang Juhua's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Zhejiang Juhua's P/E

Zhejiang Juhua's P/E is getting right up there since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Zhejiang Juhua maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Zhejiang Juhua, and understanding these should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.