Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Shenzhen Fenda Technology Co., Ltd. (SZSE:002681) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

What Is Shenzhen Fenda Technology's Net Debt?

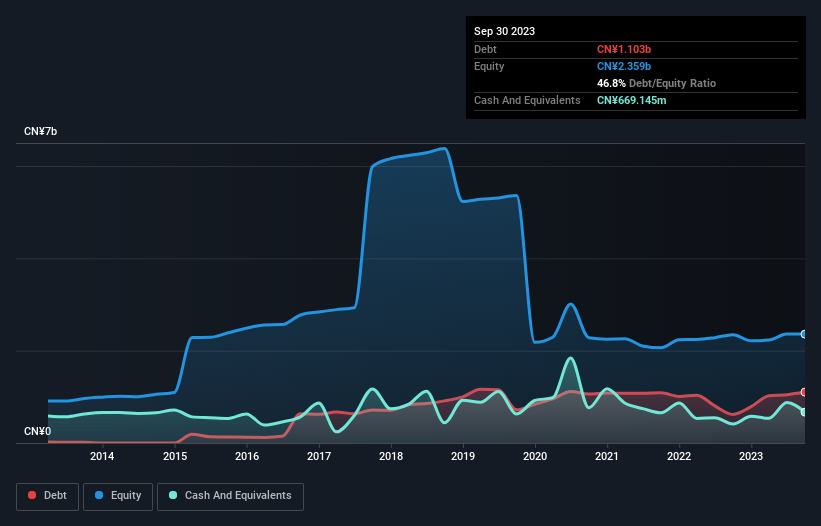

As you can see below, at the end of September 2023, Shenzhen Fenda Technology had CN¥1.10b of debt, up from CN¥620.0m a year ago. Click the image for more detail. However, it does have CN¥669.1m in cash offsetting this, leading to net debt of about CN¥433.7m.

How Healthy Is Shenzhen Fenda Technology's Balance Sheet?

The latest balance sheet data shows that Shenzhen Fenda Technology had liabilities of CN¥1.20b due within a year, and liabilities of CN¥937.3m falling due after that. Offsetting this, it had CN¥669.1m in cash and CN¥847.3m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥625.1m.

Of course, Shenzhen Fenda Technology has a market capitalization of CN¥7.70b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Shenzhen Fenda Technology's net debt is sitting at a very reasonable 2.4 times its EBITDA, while its EBIT covered its interest expense just 4.7 times last year. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Pleasingly, Shenzhen Fenda Technology is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 125% gain in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Shenzhen Fenda Technology's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last two years, Shenzhen Fenda Technology recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

When it comes to the balance sheet, the standout positive for Shenzhen Fenda Technology was the fact that it seems able to grow its EBIT confidently. But the other factors we noted above weren't so encouraging. In particular, conversion of EBIT to free cash flow gives us cold feet. When we consider all the elements mentioned above, it seems to us that Shenzhen Fenda Technology is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Shenzhen Fenda Technology's earnings per share history for free.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.