Unfortunately for some shareholders, the Infinity Logistics and Transport Ventures Limited (HKG:1442) share price has dived 48% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 73% share price decline.

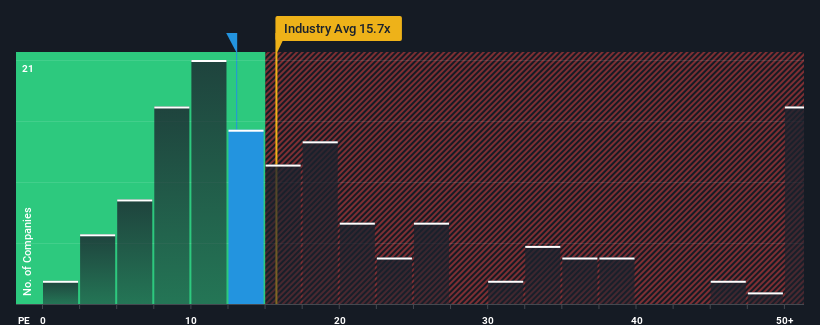

Although its price has dipped substantially, Infinity Logistics and Transport Ventures may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 13x, since almost half of all companies in Hong Kong have P/E ratios under 8x and even P/E's lower than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

As an illustration, earnings have deteriorated at Infinity Logistics and Transport Ventures over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Infinity Logistics and Transport Ventures' is when the company's growth is on track to outshine the market.

The only time you'd be truly comfortable seeing a P/E as high as Infinity Logistics and Transport Ventures' is when the company's growth is on track to outshine the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 33%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 7.4% in total. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

This is in contrast to the rest of the market, which is expected to grow by 24% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Infinity Logistics and Transport Ventures is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Final Word

Despite the recent share price weakness, Infinity Logistics and Transport Ventures' P/E remains higher than most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Infinity Logistics and Transport Ventures revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 4 warning signs for Infinity Logistics and Transport Ventures (2 are significant!) that you need to take into consideration.

Of course, you might also be able to find a better stock than Infinity Logistics and Transport Ventures. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.